Before we begin the newsletter - I’m excited to be speaking on June 10th at SEG3 London, a conference at the intersection of Culture and Technology, stacked with innovators from leading media, entertainment, gaming & sports brands. If you’re going to be there, please don't hesitate to say hi! And if you haven’t got your ticket yet, you can use the code 'Speaker20' to get 20% off your pass here.

Theme parks are booming

In my Disney days, as part of an executive training programme, I had the opportunity to be a Disney character in the park. See if you can guess who I was - I’ll include a photo at the end of this piece as an incentive to read to the end 😁.

Since those days, the economics of the theme park business have continued to evolve, primarily driven by:

Massive capital investment.

A focus on increasing revenue and profitability (amidst fluctuating attendance).

Leveraging IP to drive engagement and justify higher prices.

Growth through global expansion.

The engine room for studio profitability

While the studios’ streaming services have burned through mountains of cash in their quest for a scaled subscriber base, and their movies generate unpredictable hits and flops in equal measure, the theme park divisions have become the engine room for profitable growth.

[Disney], reporting results for its winter quarter, said operating profit at its domestic theme park division had climbed 13 percent from a year earlier, to $1.82 billion. Revenue increased 9 percent, to $6.5 billion … Disney also reiterated that its experiences division as a whole (including overseas parks, cruises, and games and other consumer products) was still on course to increase its operating profit as much as 8 percent for the year, compared with 4 percent in 2024. The division contributes roughly 60 percent of Disney’s annual profit. - New York Times, May 2025

Massive Investment

To drive this continued growth, the major players are investing unprecedented levels of capital into their parks and experiences.

Disney is investing $60 billion over the next decade in its Parks, Experiences, and Products division.

Universal invested over $10 billion in new and existing destinations across the US between 2018 and 2024, including approximately $7 billion for the recently opened Universal Epic Universe, the first major U.S. amusement park

to open in over two decades.

Comparatively smaller players such as Merlin Entertainments are also undertaking significant investments, including $90 million for new indoor roller coasters at Legoland Florida and California.

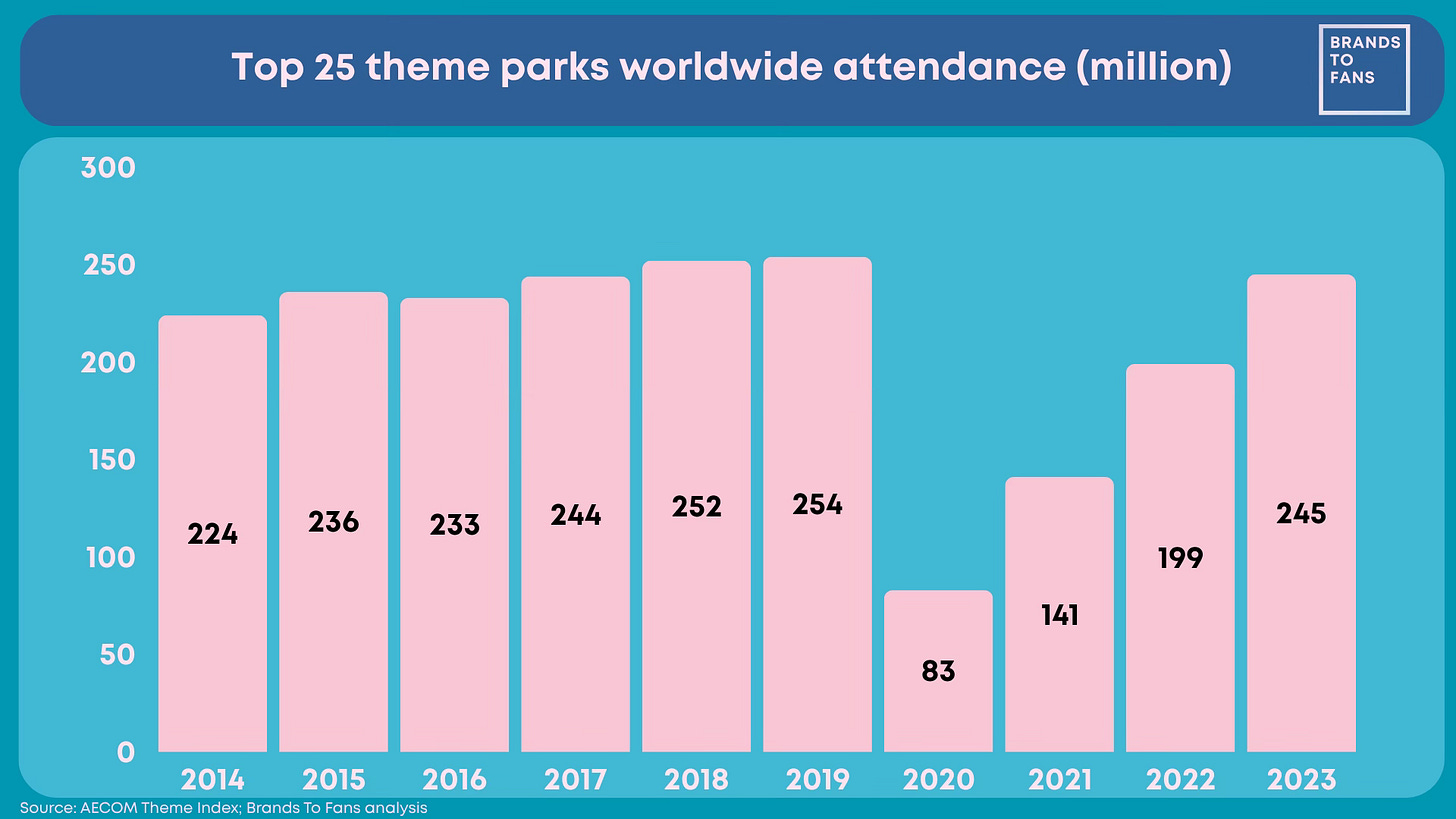

Attendance has almost returned to pre-pandemic levels

The launch of new, highly anticipated parks like Universal Epic Universe is helping boost demand for tickets and hotel bookings.

“We’ve seen strong demand since launching Epic [Universe] ticket sales in the fourth quarter of 2024, and the most recent reaction to early previews has been nothing short of phenomenal … Ticket sales and advanced plans are a little ahead of our expectations.” - Michael Cavanagh, president of Comcast, quarterly earnings call April 2025

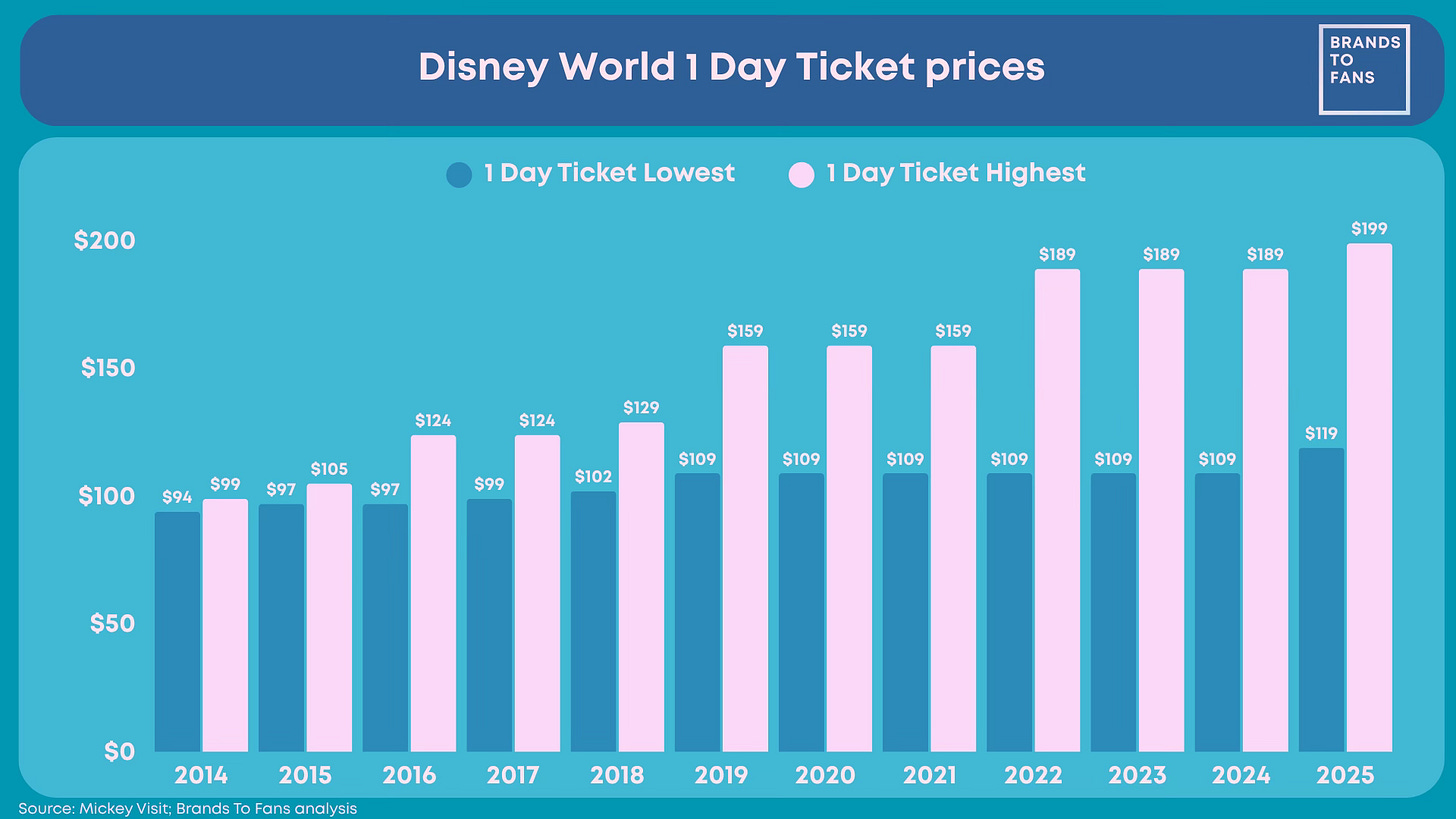

Prices are going up

“We also remain deliberate about pricing and the guest experience, and are focused on providing guests great value with a vast array of options to visit our theme parks.” - Bob Iger, Q1 2025 Earnings Call

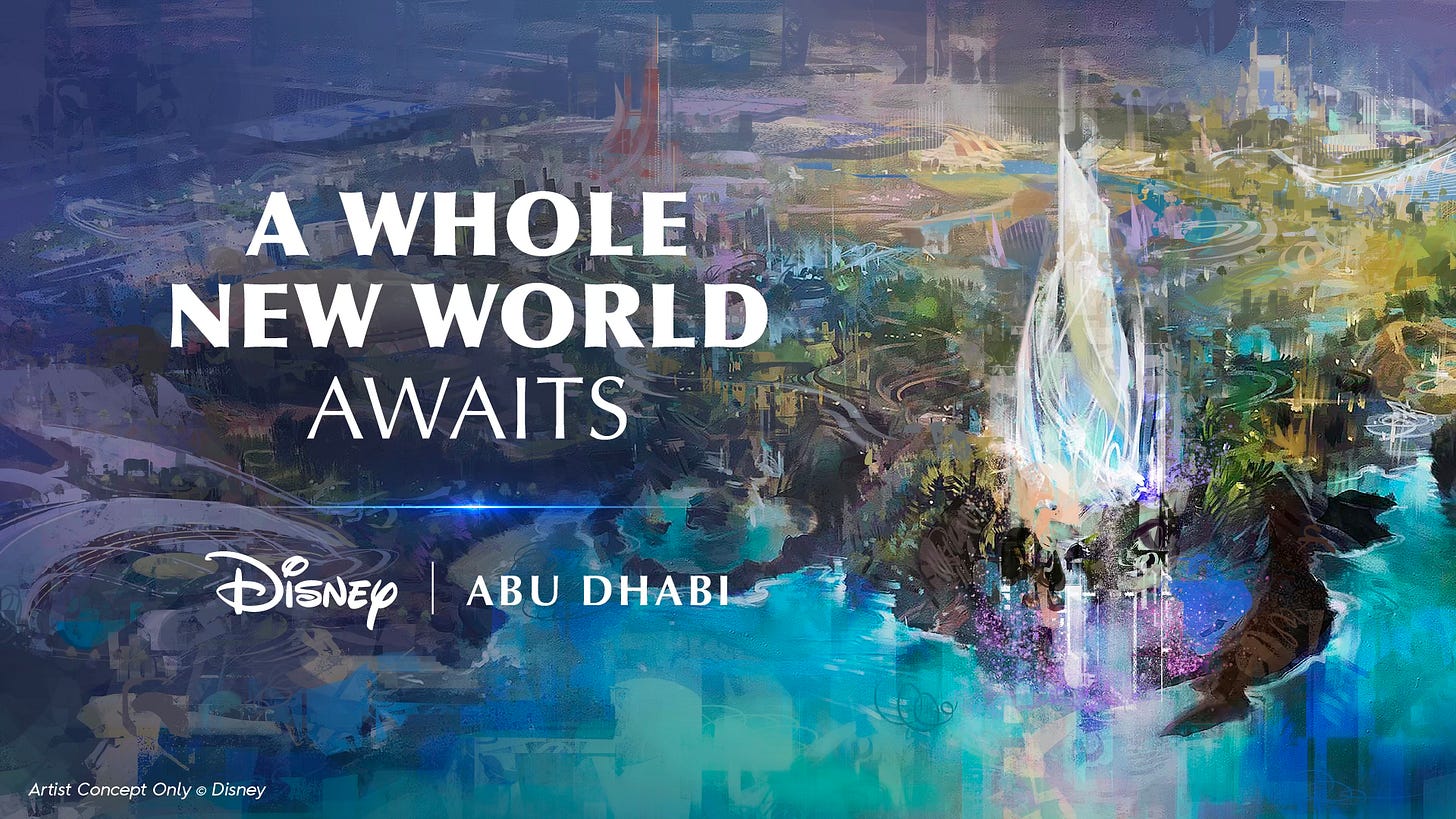

International is a key source of future growth - with new resorts and upgrades to existing parks

The recently announced Disneyland Abu Dhabi will be Disney’s seventh resort worldwide. It is planned as Disney's most advanced and interactive resort, ‘combining Disney stories and characters with Abu Dhabi's culture and architecture’. Disney’s partner Miral will handle building and operation, while Disney Imagineering leads the creative design and provides operational oversight.

Universal have announced plans to build their first theme park in the UK, in Bedford. Construction is scheduled to begin in 2026, with a grand opening targeted for 2031. I’m sure the Bond and Paddington IP-owners are standing by their phones.

Legoland Shanghai is set to open this July, featuring eight immersive lands, and over 75 interactive rides, shows, and attractions, as well as thousands of Lego models crafted from more than 85 million Lego bricks.

Shanghai Disneyland has just broken ground on a new Spider-Man land. It joins Shanghai Disneyland’s Toy Story Land, which opened in 2018, and the new Zootopia land, which debuted in late 2023.

Disneyland Paris is undergoing a €2 billion transformation to become Disney Adventure World in 2026

The new park entrance, World Premiere, opened this month

The World of Frozen land is set to open in 2026. Construction includes finishing the North Mountain structure and programming audio-animatronics for the Frozen Ever After attraction.

Construction is set to begin in autumn 2025 on the first-ever land themed to The Lion King, which will feature a major water ride incorporating advanced audio-animatronics and special effects.

A new family-friendly Up attraction (spinning carousel) will begin construction by the end of 2025. This will be the first attraction at a Disney park themed to the film.

Disneyland Paris is also set to open a Star Wars-themed Lounge Lightspeed, where guests can meet BDX droids.

Domestic parks are also receiving upgrades and new launches

The U.S. theme park market is also receiving huge investment (in addition to Universal Epic Universe).

The first-ever Universal Kids Resort is set to debut in Frisco, Texas in 2026. It will focus on family-friendly attractions rather than high-thrill rides. Confirmed IP includes Shrek, SpongeBob SquarePants, Minions, Jurassic World, Trolls, Puss in Boots, and Gabby's Dollhouse.

Disney is busy upgrading its U.S. parks:

Walt Disney World’s Magic Kingdom is undergoing its largest expansion ever, with a new area based on Cars and a new villain-themed land.

Walt Disney World’s Animal Kingdom is developing a new Tropical Americas land, including attractions inspired by Encanto and Indiana Jones.

A Monsters, Inc. roller coaster is coming to Disney's Hollywood Studios in a new Monstropolis land (replacing Muppet*Vision 3D, which closes in June). This will be Disney’s first suspended roller coaster with a unique vertical lift loading process.

Disneyland’s Avengers Campus is receiving a major expansion, including a Stark Flight Lab ride, featuring a robotic arm that lifts and manoeuvres ride pods.

In addition to Legoland Florida’s new roller coaster, the park also opened a new Sea Life attraction this week, with 75 interactive exhibits and more than 3,000 animals.

IP is the rocket fuel for theme park growth

For blue-chip IP, theme park opportunities represent both financial upside and an opportunity to extend and deepen fan engagement with the brands.

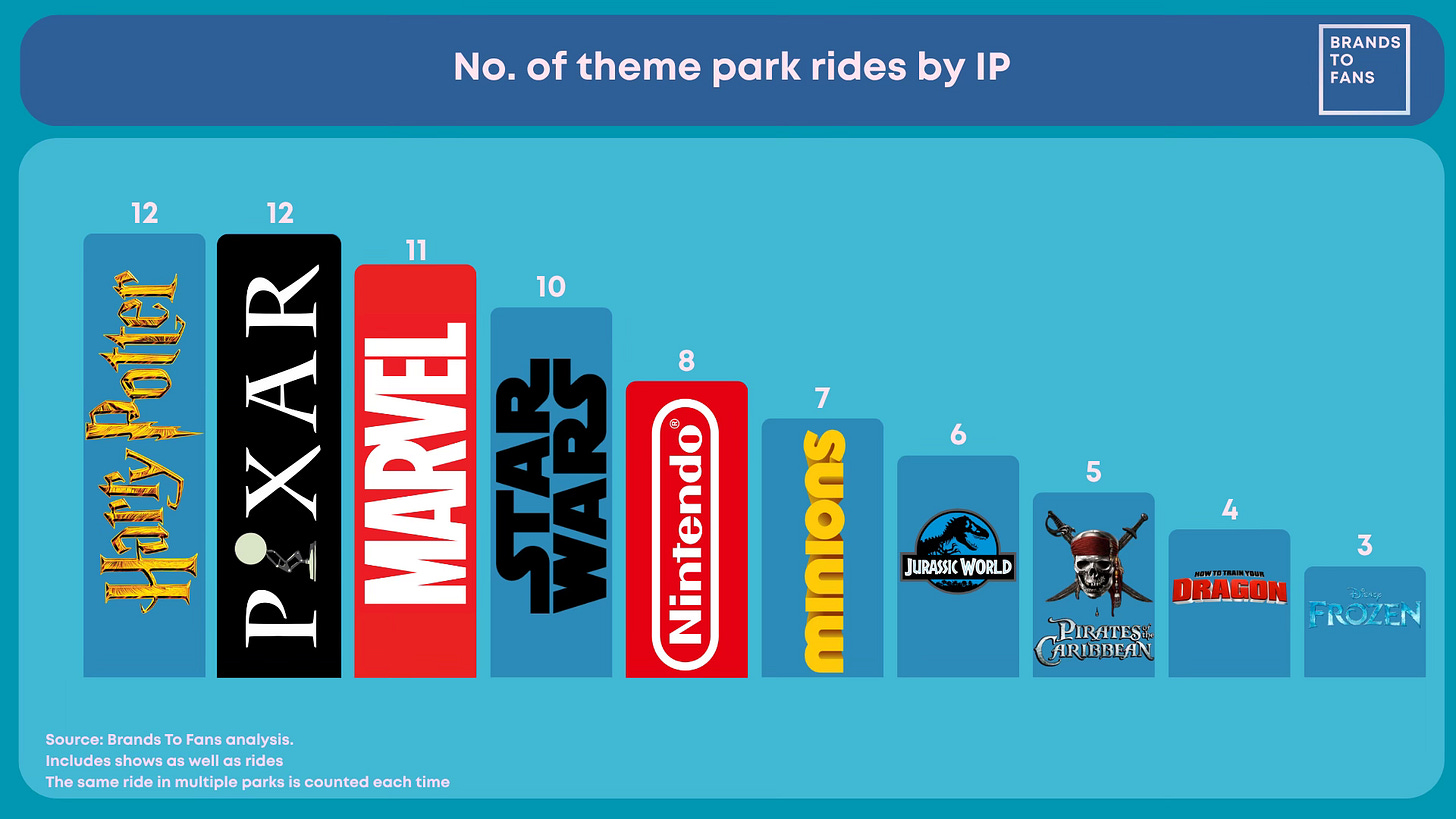

Harry Potter and Pixar boast the greatest number of rides (the chart below is not quite comparing apples with apples, as Marvel and Pixar could be considered umbrella brands containing multiple individual IPs - and the chart should probably include Disney as an umbrella brand for its classic IP as well…).

Here is how the blockbuster brands break down:

Marvel rides appear in Universal’s Islands of Adventure, as well as Disney parks, due to a historical licensing deal:

Although the studios tend to favour their owned IP, licensing opportunities can still exist for 3rd party IP. Universal’s deal with Warner Bros. Discovery for Harry Potter is the biggest example. And licensing deals continue to be struck: Merlin just announced a deal with Paramount for the UK’s first Paw Patrol land, at Chessington World of Adventures.

Prioritise deep immersion and storytelling authenticity

Theme parks are evolving to create highly immersive worlds where guests feel transported into the story. For IP owners, this means ensuring that the park experience authentically captures the essence, details, and narrative of their brand.

Often this is achieved through collaboration with the IP's original creators - for example, Stuart Craig (the production designer for the Harry Potter and Fantastic Beasts films) and his team have been involved in the creation of all of the Wizarding World projects at the Universal parks.

Talent from the original movies can also be leveraged to bring that authenticity and continuity:

The new Harry Potter and the Battle at the Ministry ride at Universal’s Epic Universe features Imelda Staunton reprising her role as Dolores Umbridge from the movies.

Robert Downey Junior is returning as Tony Stark for Disneyland’s new Stark Labs ride.

Original talent can also help with publicity. I’m pretty sure that if you were opening a Harry Potter envelope, these two would be happy to help (and do a great job):

Embrace cutting-edge technology

Modern theme parks are heavily reliant on innovative technology to enhance immersion and create unique experiences.

IP owners can now leverage technologies like advanced animatronics, innovative ride systems, seamless integration of physical sets and digital media, augmented reality, and interactive elements like wands or wearables to bring their IP to life in exciting and novel ways.

Many of Super Nintendo World’s attractions and experiences are interactive and gamified. Guests can jump and punch Question Blocks to collect virtual coins using a Power-Up Band wearable device. Visitors can also earn digital keys to unlock content and compete with other guests.

“Think of Super Nintendo World as a life-size, living video game where you become one of the characters. You’re not just playing the game; you’re living the game, you’re living the adventure … We have developed state-of-the-art technology to create the perfect fusion of the physical world with the world of video games.” - Thierry Coup, SVP and CCO, Universal Creative (Blooloop)

Universal have rolled out second-generation Harry Potter wands at the Wizarding World of Harry Potter in Orlando. Available in four designs, they enable an enhanced immersive experience at the park’s locations, in conjunction with a new feature in the Universal Orlando Resort App, called Universal Play. With light and haptic effects, users can cast spells, from tackling pixies in Hogsmeade to conjuring a Patronus in Knockturn Alley.

In the new Epic Universe land How to Train Your Dragon – Isle of Berk, Toothless the dragon is the first animatronic theme-park character that guests can interact with and touch.

It was an experience straight out of a fairy tale: the chance to meet a dragon. One by one, visitors walked up to an inky black creature named Toothless. When a visitor stroked the top of his head, Toothless closed his eyes and sighed a calm, blissful sound that prompted smiles, laughs and even tears from the crowd. There was no puppeteer pulling strings, no human inside a costume. It was just like being in “How to Train Your Dragon,” and that is the point. - Wall Street Journal

Beyond the ride

The immersion goes far beyond the ride to include highly detailed environments, themed dining and retail, character interactions, and attractions that place guests within scenes or narratives from the IP. Disney Imagineers love to talk about the storytelling built into what they call ‘the pre-ride experience’ (what you or I would call ‘the queue’).

As top-tier IP extends across multiple formats, theme parks represent an always-on, real-world environment where fans can fully engage with a brand, deepening their connection, creating memories ... and spending money at the gift shop.

Before moving on to this week’s franchise management news, here is the photo I promised of me in the Disney park as … yes, Goofy (very predictable).

Franchise news roundup

Each week, we round up franchise management news, focusing in particular on items that tie back to topics addressed in previous newsletters.

Preschool, Kids & Family

(Read my post Whole Lotta Bluey here.)

Bluey has amassed 70 billion minutes viewed since the start of 2024. Read More

CoComelon is moving from Netflix to Disney+. Read More

Hasbro introduces Peppa Pig’s baby sister, Evie, with a slate of product launches. Read More

Nike and the Lego Group announced a global multi-year partnership, launching this Summer with a series of immersive experiences and co-branded products ‘designed to inspire kids everywhere to embrace the joy of active and creative play’. Read More

Action franchises

(Read my action smackdown post Into The Neesonverse here.)

From the World of John Wick: Ballerina has secured a June release in China. Read More. In addition, Lionsgate is making tickets for the movie available to purchase in the US through TikTok Shop, allowing users to buy tickets directly within the social media app during a livestream of the film’s world premiere in the UK. Read More

Faith-based franchises

(Read my post How faith-based content is driving innovation in funding, distribution and fan engagement here.)

The Chosen will release two standalone films to theatres. Amazon MGM will release the Season 6 finale of The Chosen, portraying the crucifixion of Jesus, as a feature film exclusively in theatres on March 12, 2027; meanwhile, Season 7 will begin with a feature film depicting the resurrection of Jesus, also exclusively in theatres, on March 31, 2028. Both are being produced as standalone films, designed for the big-screen experience. I don’t know when Mel Gibson’s The Resurrection of the Christ will release, but part of me wants a head-to-head showdown ... Read More

Fox Nation have commissioned two further seasons of Jesus: Crown of Thorns. Read More

Faith-based Angel Studios is releasing their first romantic comedy, Solo Mio, next February, starring Kevin James, Alyson Hannigan, and Jonathan Roumie (who plays Jesus in The Chosen). Read More

Angel Studios has also released the first episode of fantasy adventure The Wayfinders on Angel.com and the Angel app. The whole season will be available to stream in September. Jordan Harmon, president of Angel, said: “The Angel Guild has enthusiastically supported the first episode, and we know the series will capture the viewers’ imagination. We believe The Wayfinders will be like Narnia for a new generation.” Read More

Stage 🔄 Screen

(Read my post Why all the world's a stage (as long as it's based on a movie) here.)

Mama Mia is returning to Broadway for a limited engagement, with rumours of Sabrina Carpenter being sought for a third movie, and talk of a possible TV version. Read More

Creators

(Read my post How the Creator Economy is adapting and supercharging the traditional franchise flywheel here.)

Jack Link’s has partnered with MrBeast on a line of co-branded protein-packed meat snack products. Read More

Creator Ventures has raised a $45 million fund to back consumer internet startups. Read More

Tabletop games

(Read my post 9 brand-extension lessons from Monopoly here.)

Monopoly has announced a range of partnerships in celebration of its 90th anniversary. Read More

Live-action remakes

(Read my post Why live-action remakes are not going anywhere here.)

Henry Cavill’s live-action Voltron has wrapped production. Read More