I have a pet peeve about mainstream coverage of movie releases: it is when, for example, a $100 million-budget movie makes $100 million at the box office, and the coverage refers to it “making its money back” or, worse, “breaking even.”

The reason this makes no sense is:

Every Box Office dollar is split between the studio/distributor and the theatre.

There are costs beyond the production budget of a movie that need to be recouped before it can be considered to have broken even.

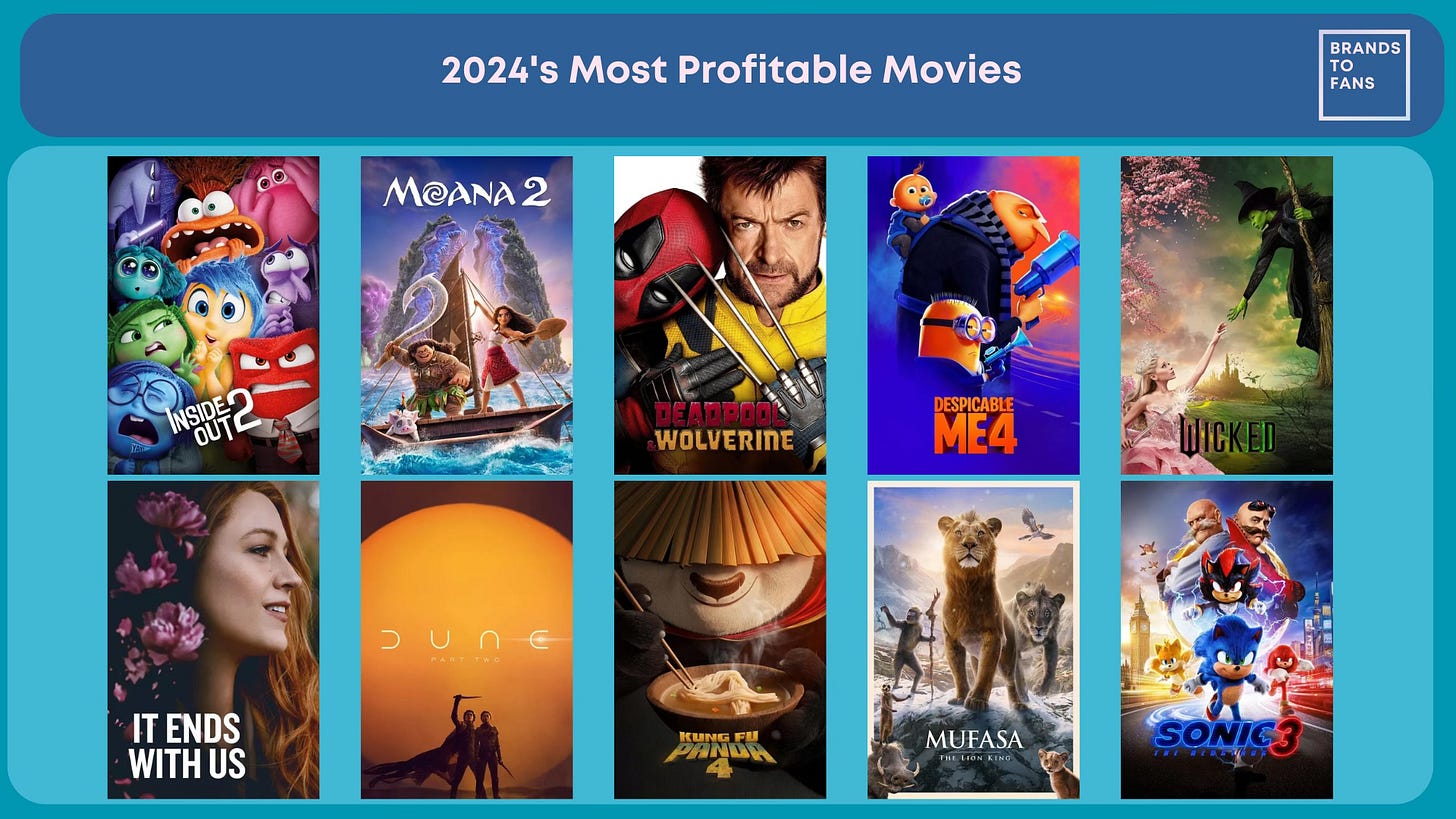

Every year, Deadline publishes a ‘Most Profitable Movie Blockbuster’ tournament. I have analysed the Top 10 movies from 2024 to create an average ‘profitable movie’ economic profile, which I’m going to break down for you here.

I have also looked at ten years of data and 100 ‘profitable’ movies to see which aspects of this economic profile are changing over time (note: these 10 years are 2013-2024, with 2020 and 2021 excluded due to the pandemic).

The Waterfall

As a movie generates revenue across different release windows, that revenue flows through an economic structure that is dictated by the funding and rights associated with the movie.

Some of movie’s costs will be fixed costs that must be recouped before the next entitled party in the chain receives any money - think of those as ‘buckets’ of a defined size that need to be filled up before the revenue ‘overflows’ and the waterfall can continue.

Other parties in the structure might have ongoing entitlements - think of those as siphons that take a portion of the waterfall away on ongoing basis while the rest keeps flowing.

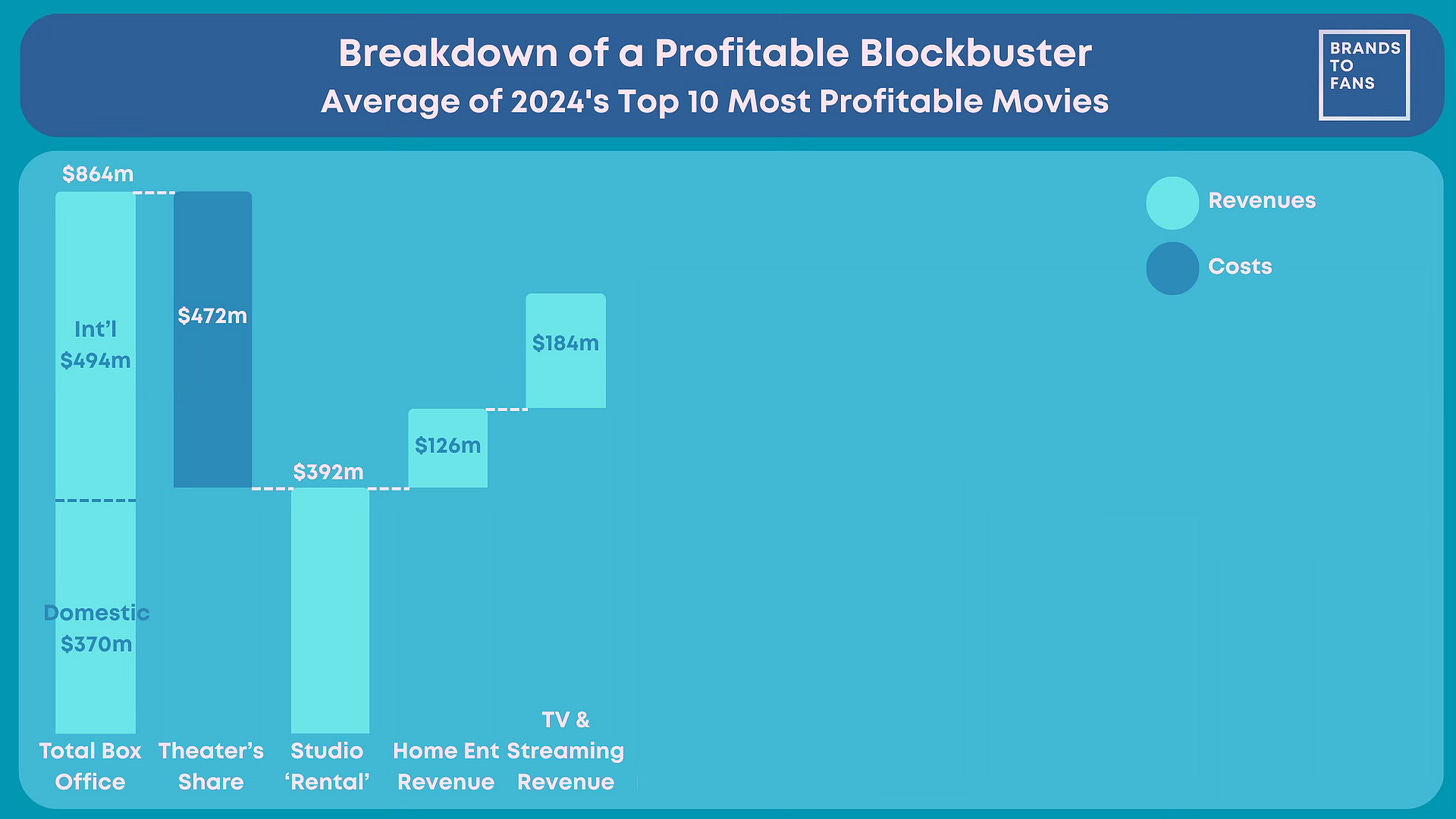

Box Office

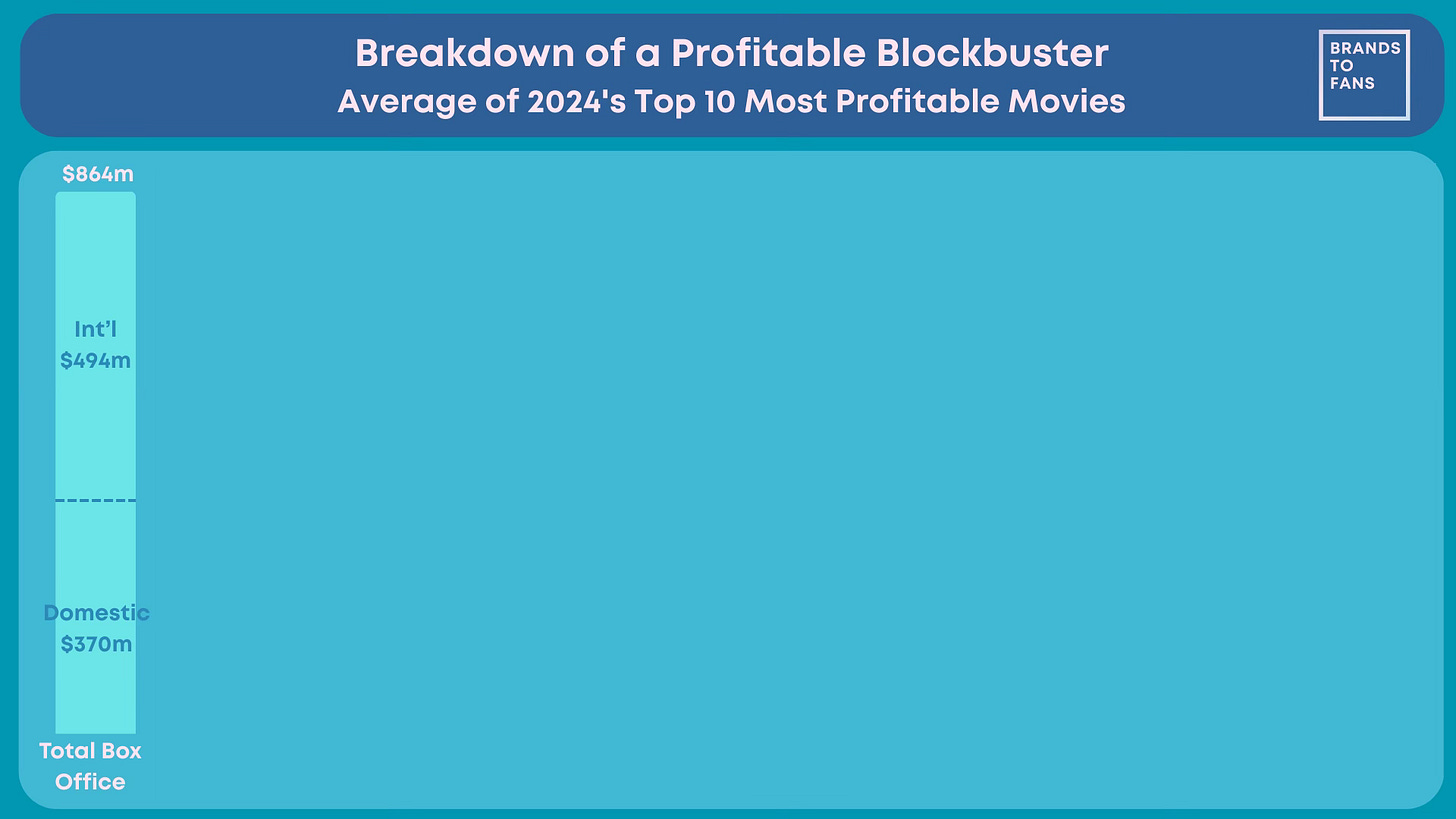

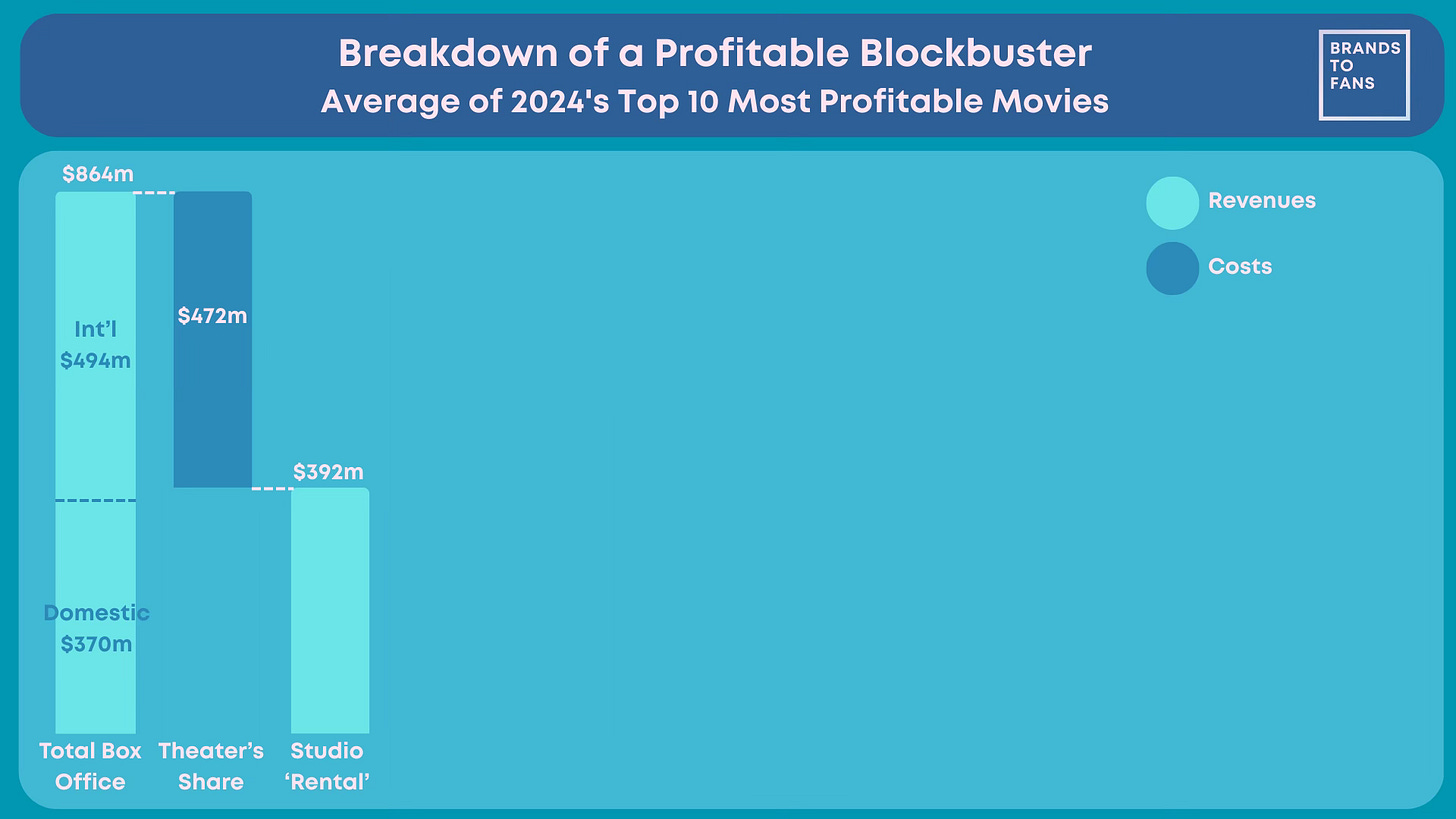

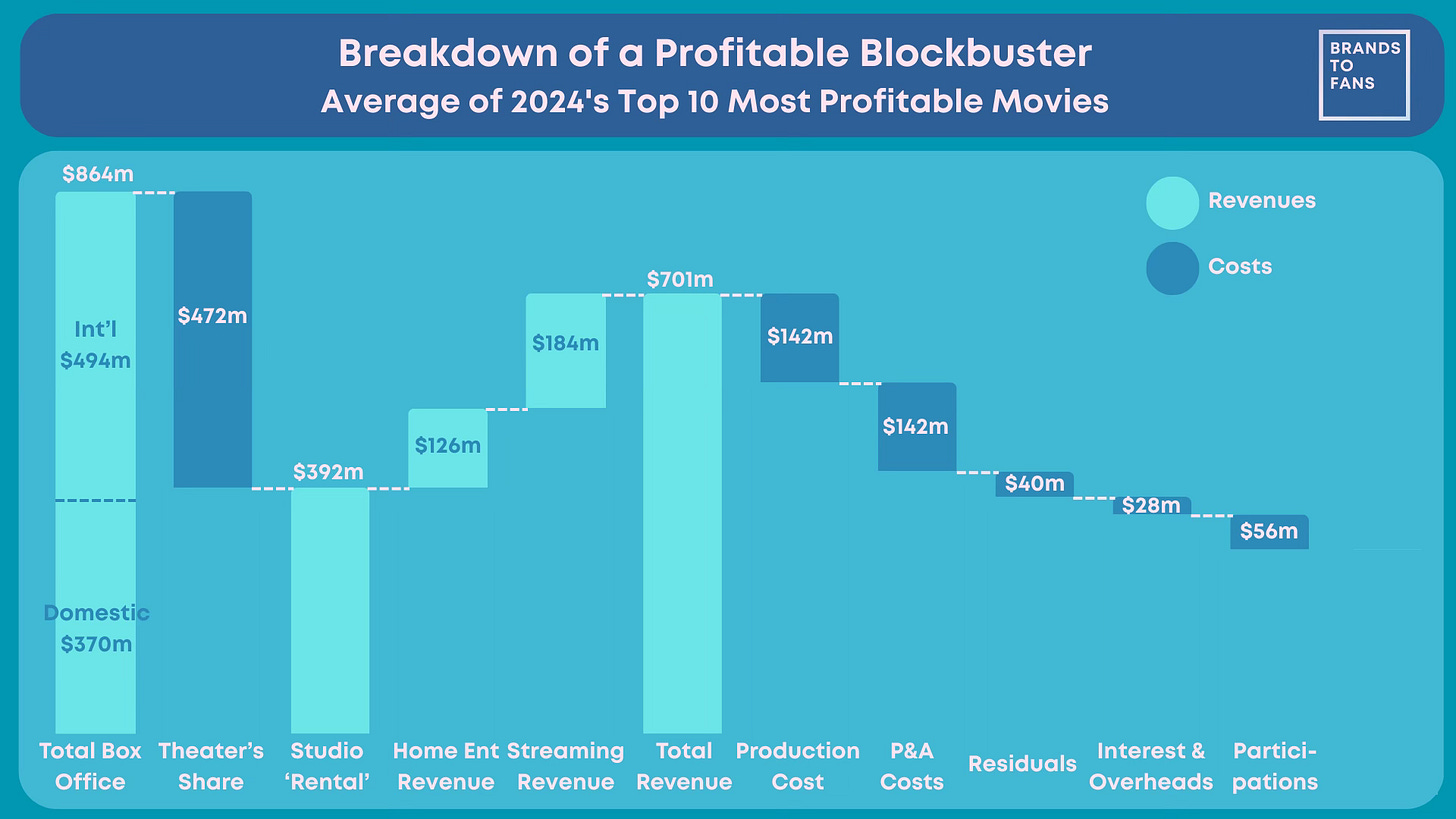

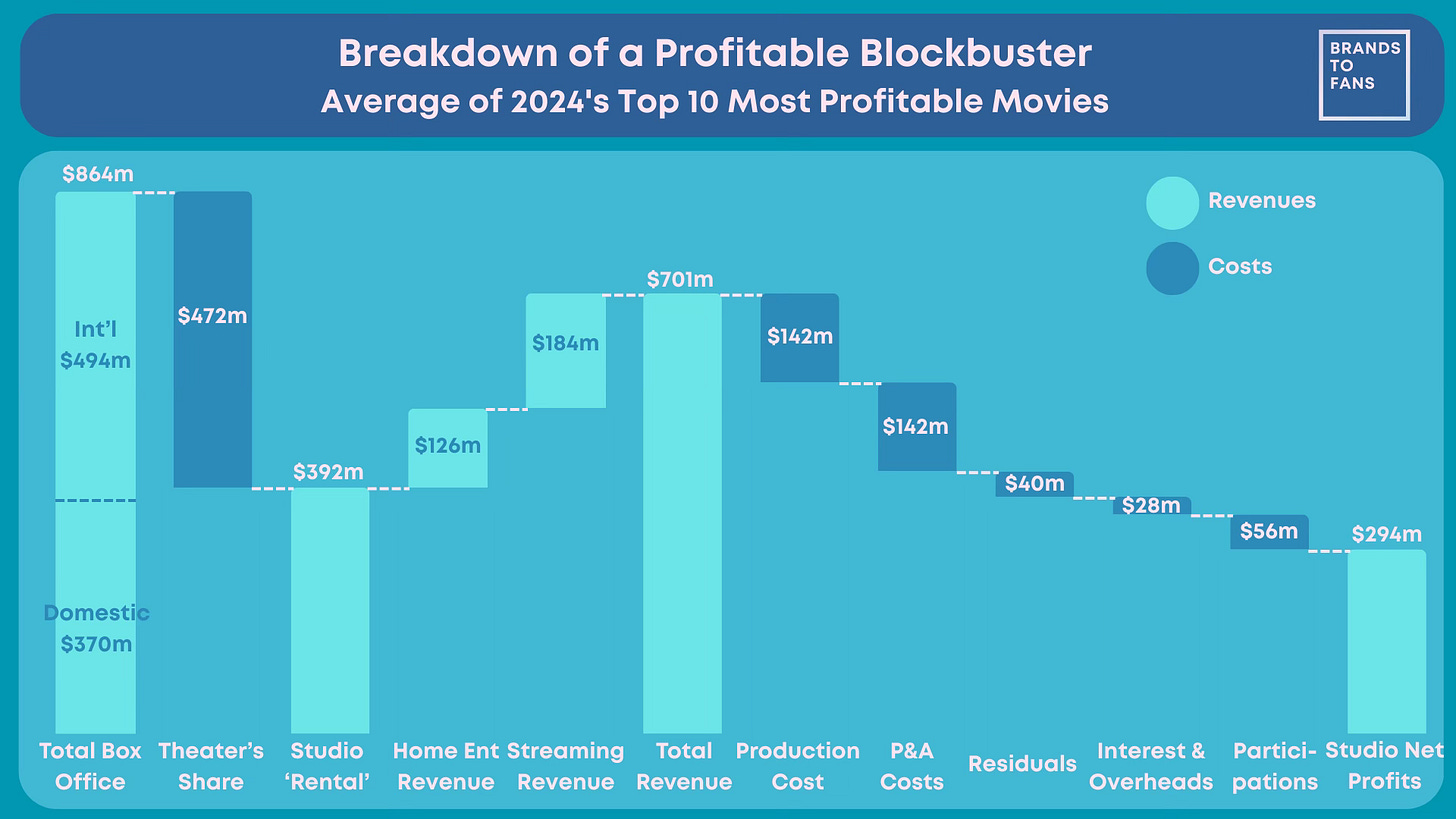

Starting on the left of our waterfall, the first revenue generated by a blockbuster movie is at the theatre. Below is the average achieved by our 2024 Top 10 Most Profitable Movies.

2024’s Top 10 Most Profitable Movies generated an average of $864 million at the Box Office, 57% of which ($494 million) was from International and 43% ($370 million) of which was from Domestic (i.e. the US).

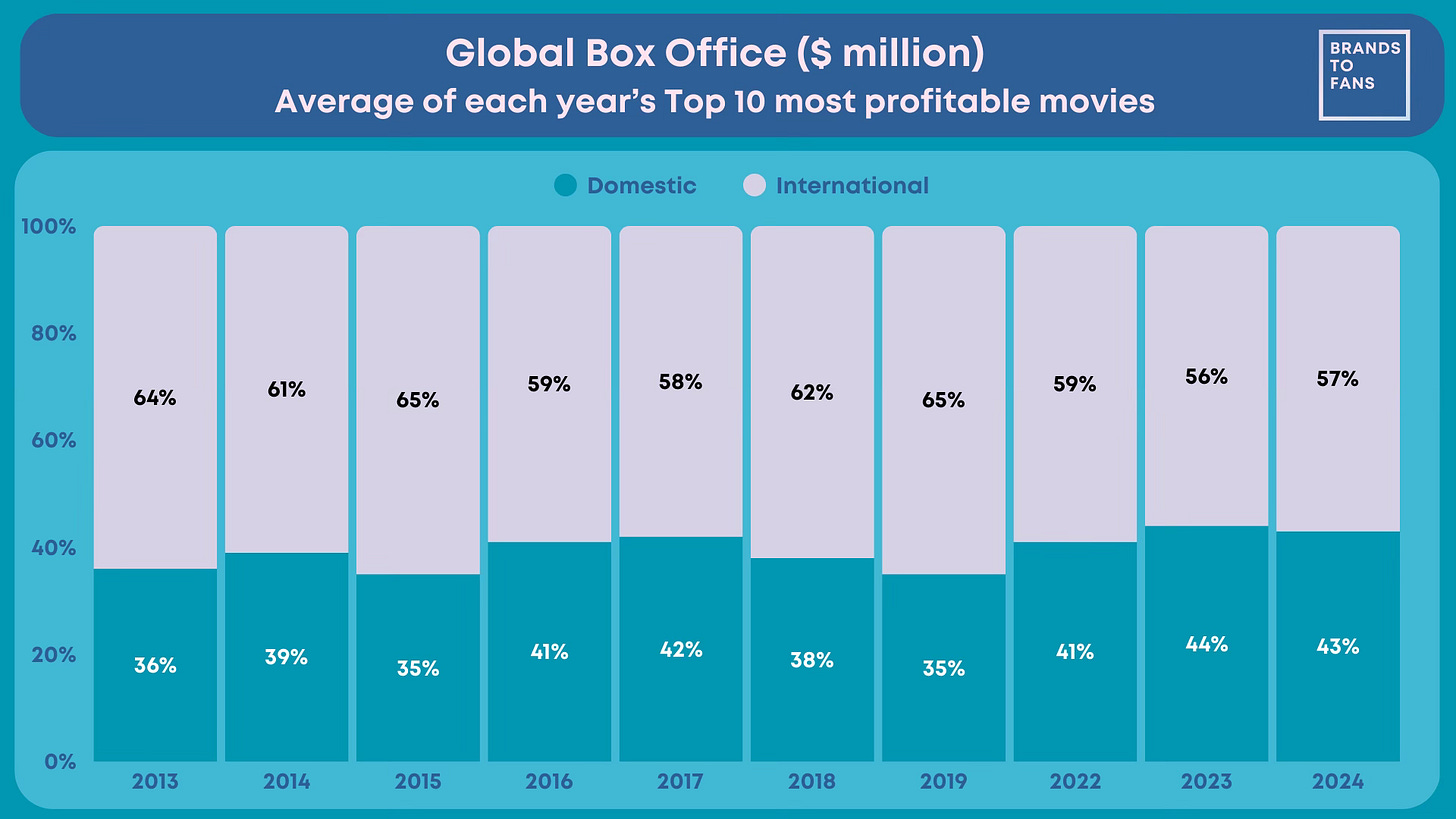

Over a 10-year period, here is how the International/Domestic box office split breaks down for each year’s Top 10 Most Profitable Movies:

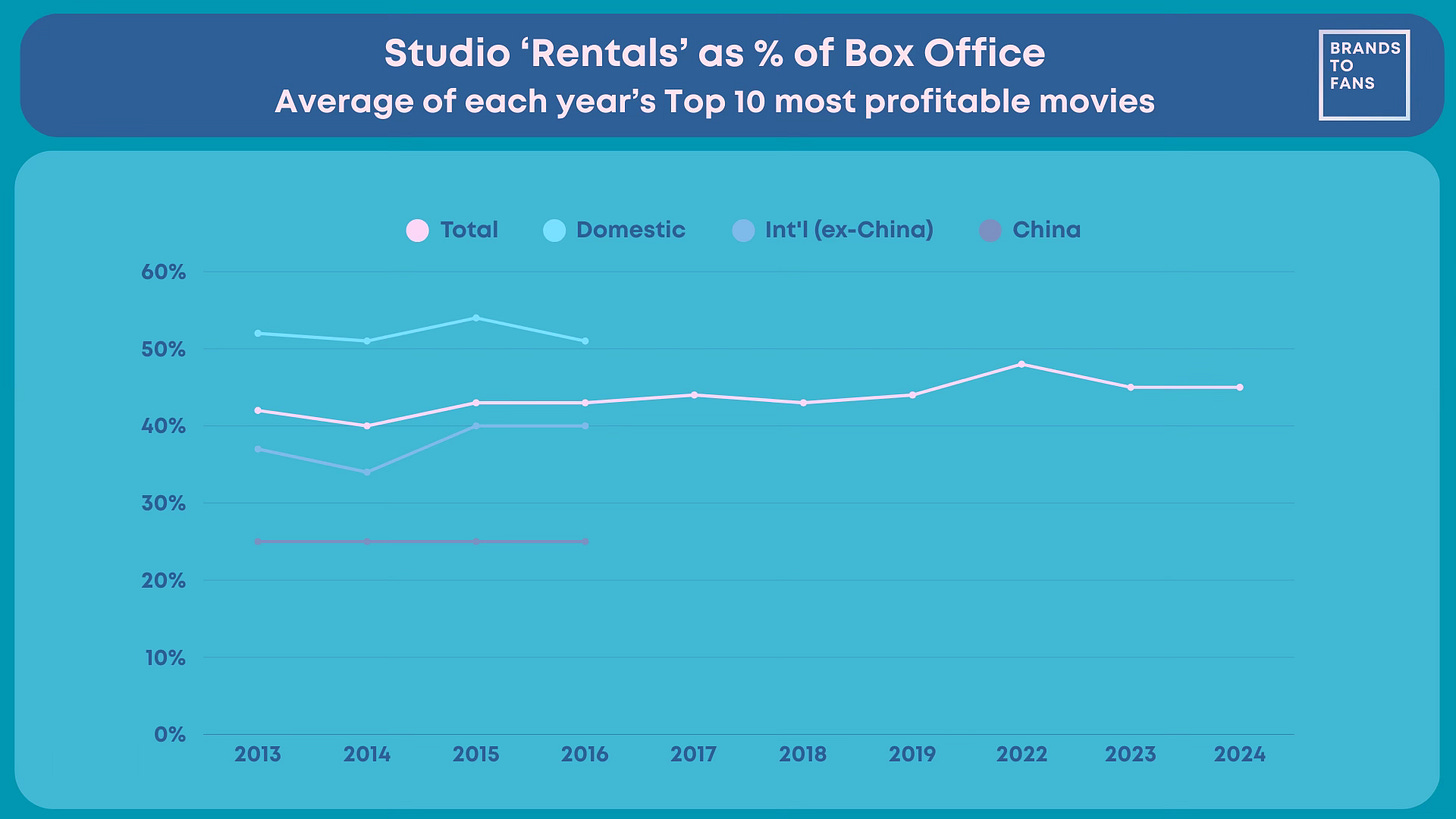

The International percentage has declined somewhat, but overall it is a fairly consistent picture. This surprised me a bit because China has dramatically reduced as a source of Box Office for US movies in recent years.

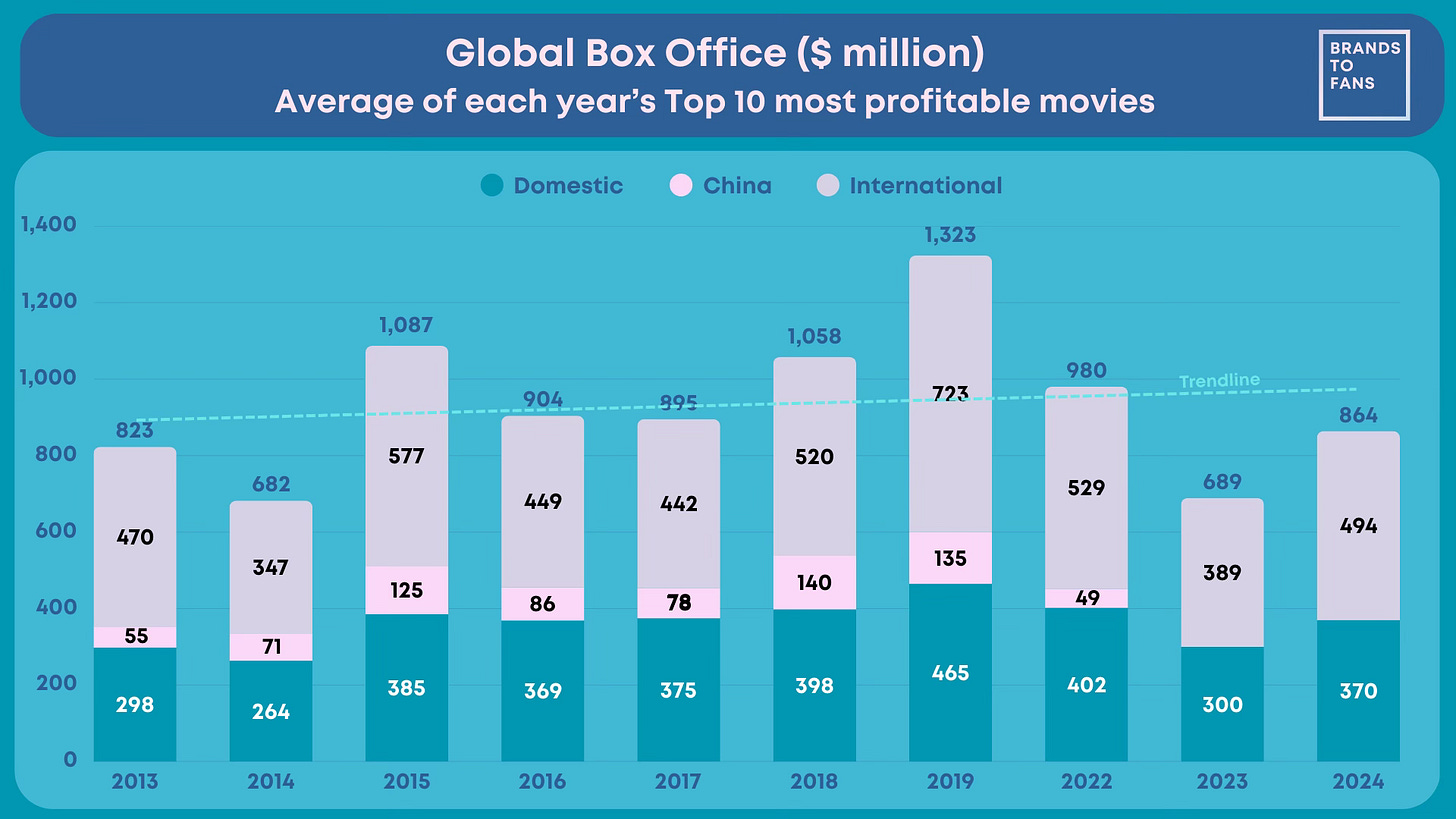

Here is the same 10-year Box Office breakdown data in absolute dollar terms (rather than %).

The Deadline data used to break out China separately, as shown in the chart, but since 2023 it has been subsumed into the International number. International Box Office revenue has declined in the last couple of years vs the peak in 2019, but Domestic has declined as well, which is why the percentage breakdown in the previous chart has stayed reasonably consistent.

Rentals

To return to our 2024 waterfall, the split of this Box Office revenue between the theatre and the studios can vary by territory (and also according to the strength of the title and the amount of leverage the studio has when negotiating terms), but a broad rule of thumb has always been that the Studio keeps 50% in the US, 40% internationally, and 25% in China. So the breakdown of Box Office revenue by region shown in the above chart matters, because the revenue-share splits differ by region.

China Box Office may have declined for these titles over time, but the studio only receives 25% of China Box Office revenue anyway, which mitigates the impact of this trend.

The studio’s share is referred to as the ‘rental’. In 2024, the average studio rental across the Top 10 Most profitable Movies amounted to 45% of the global box office ($392 million rental from $864 million global box office).

The chart below shows how these average splits have evolved over the last 10 years (the Deadline data only breaks out China, International and Domestic for 2013-16).

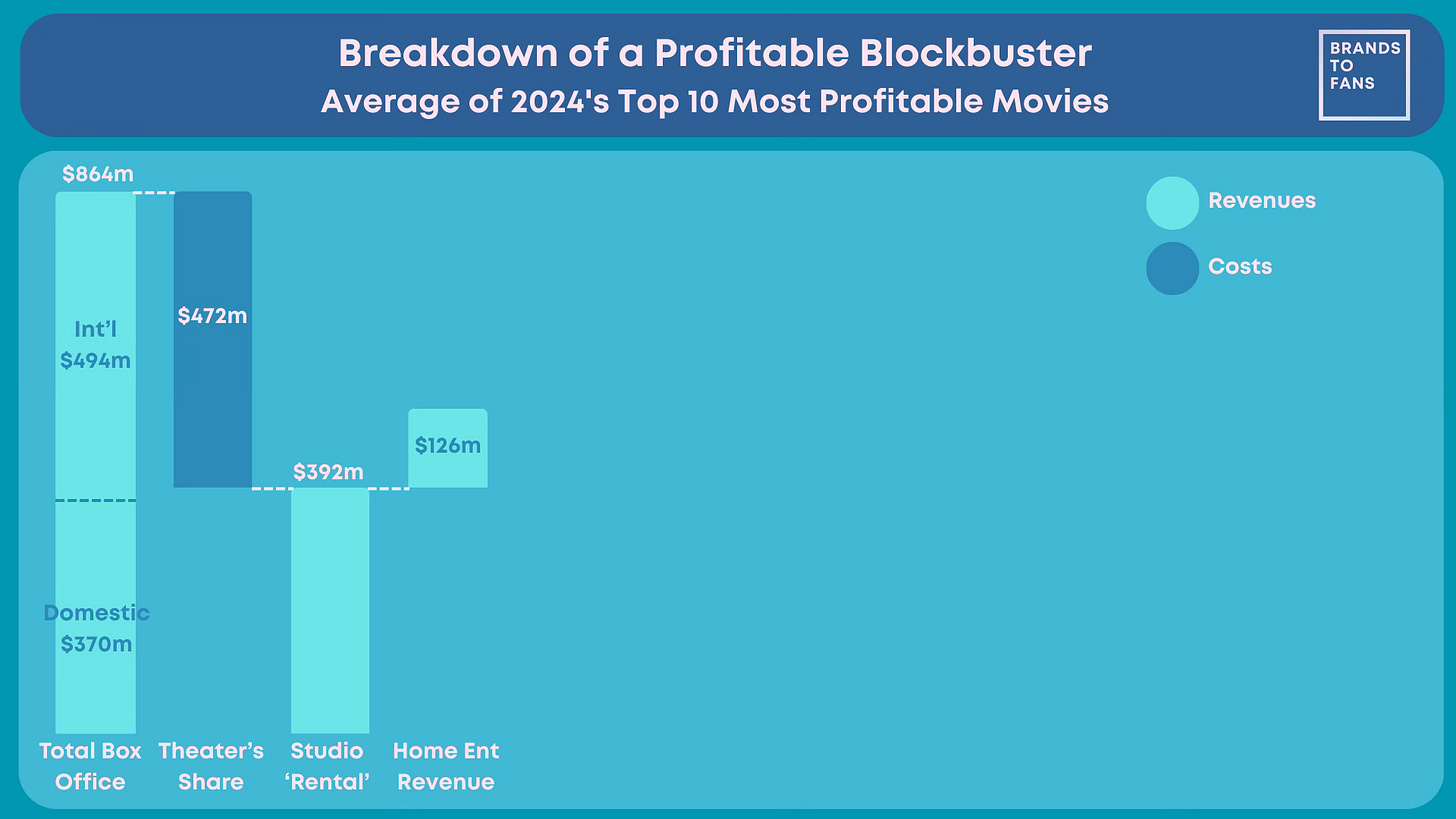

Home Entertainment

Following the theatrical window, the next revenue stream is from Home Entertainment. This covers physical DVDs (rental and sale) and digital copies of the movie (rental and sale).

For our 2024 Top 10 most profitable movies, this averaged $126 million.

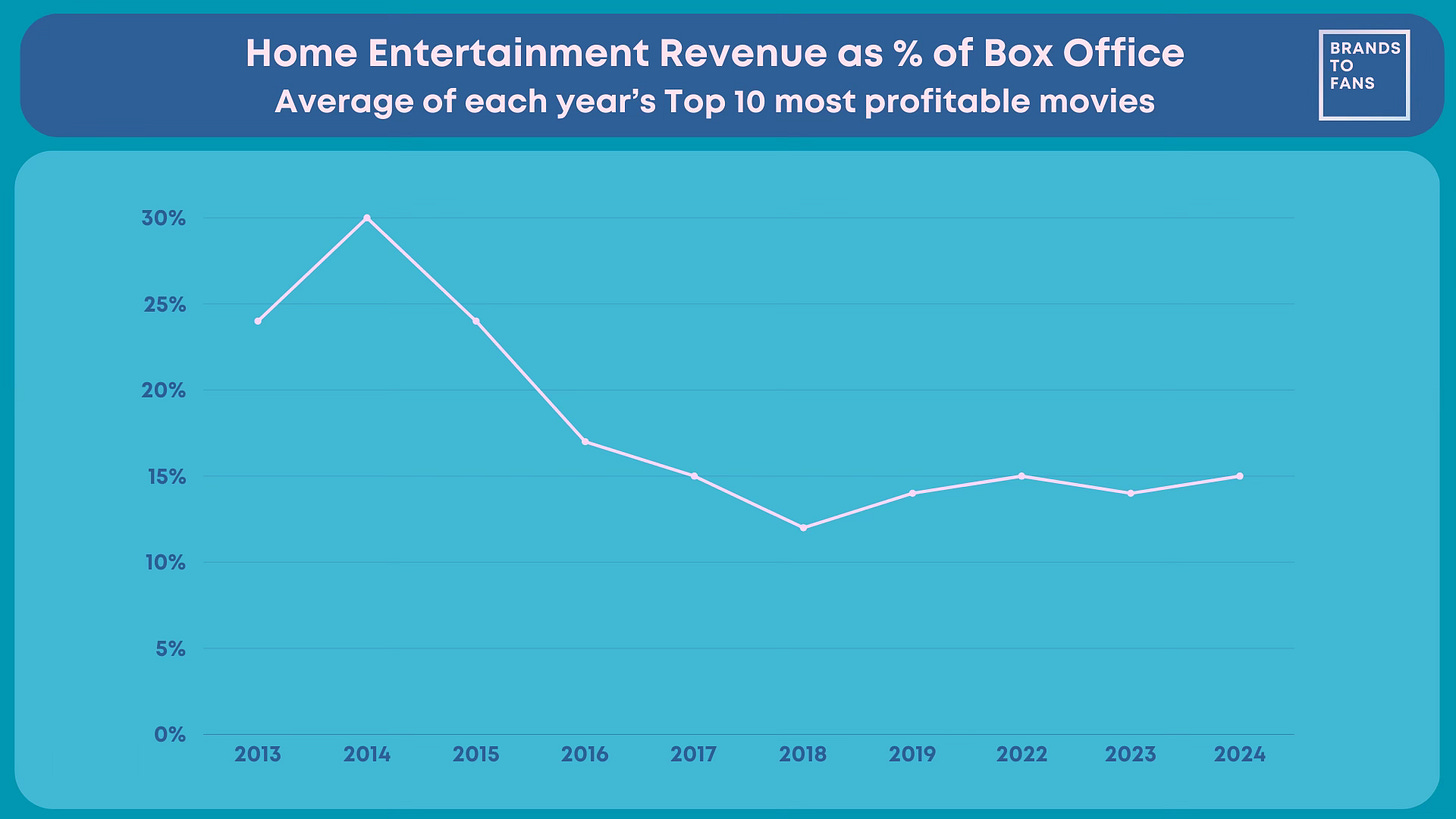

Given the state of the DVD market, I expected Home Entertainment revenue as a percentage of Box Office revenue to be continuously declining. However, looking at our 10 years of data, it appears that the slump took place in the 6 years from 2013 to 2018, and that this ratio has stabilised and is now actually increasing slightly.

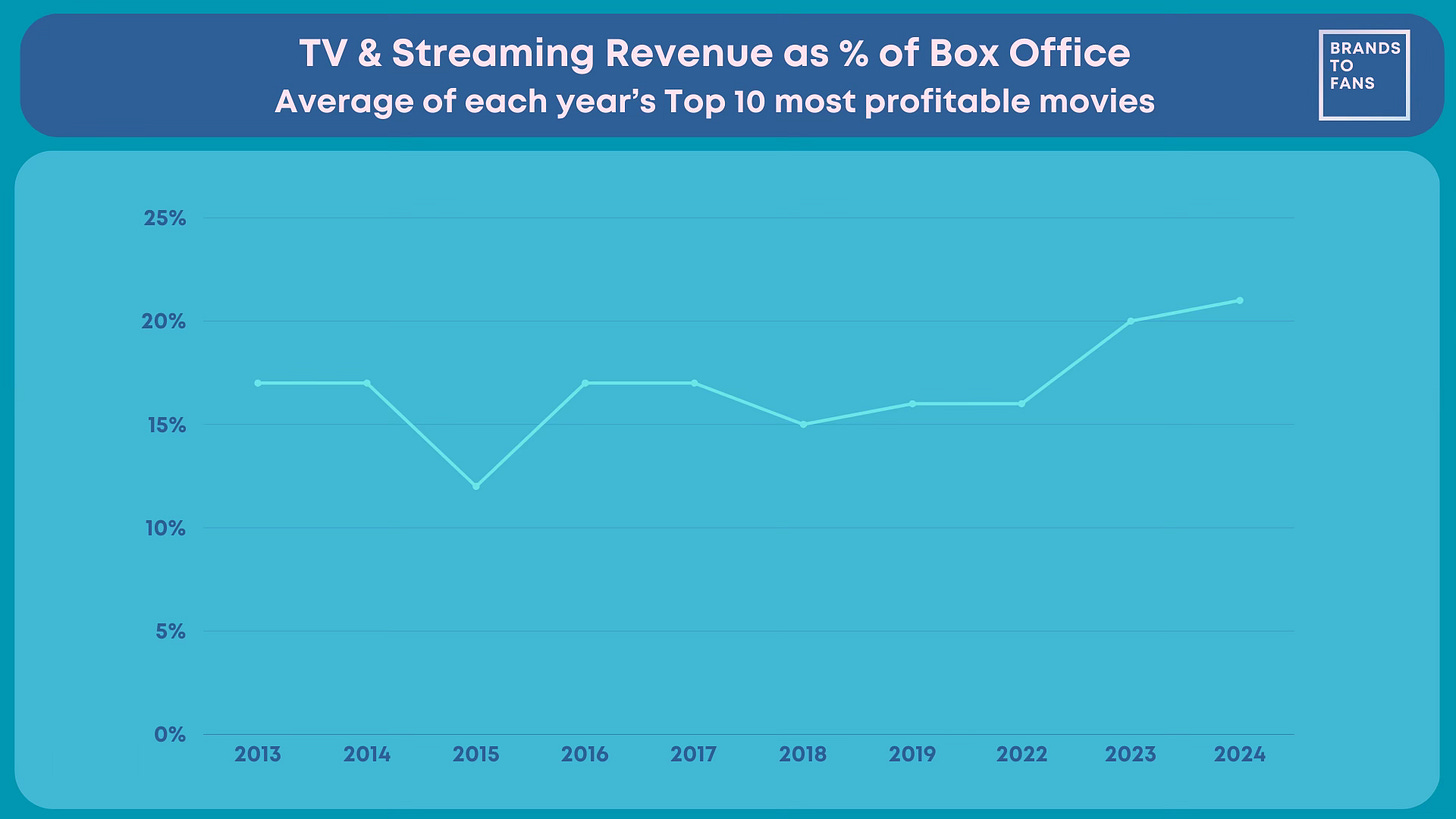

TV & Streaming Revenue

Next, our 2024 Top 10 Most Profitable Movies averaged $184 million in TV & Streaming Revenue.

If these titles are flowing through studio output deals with broadcasters and streamers, the TV & Streaming Revenue will often be dictated by tiered rate cards that escalate according to the movie’s level of success at the Box Office.

TV and Streaming Revenue as a % of Box Office appears to be on the rise:

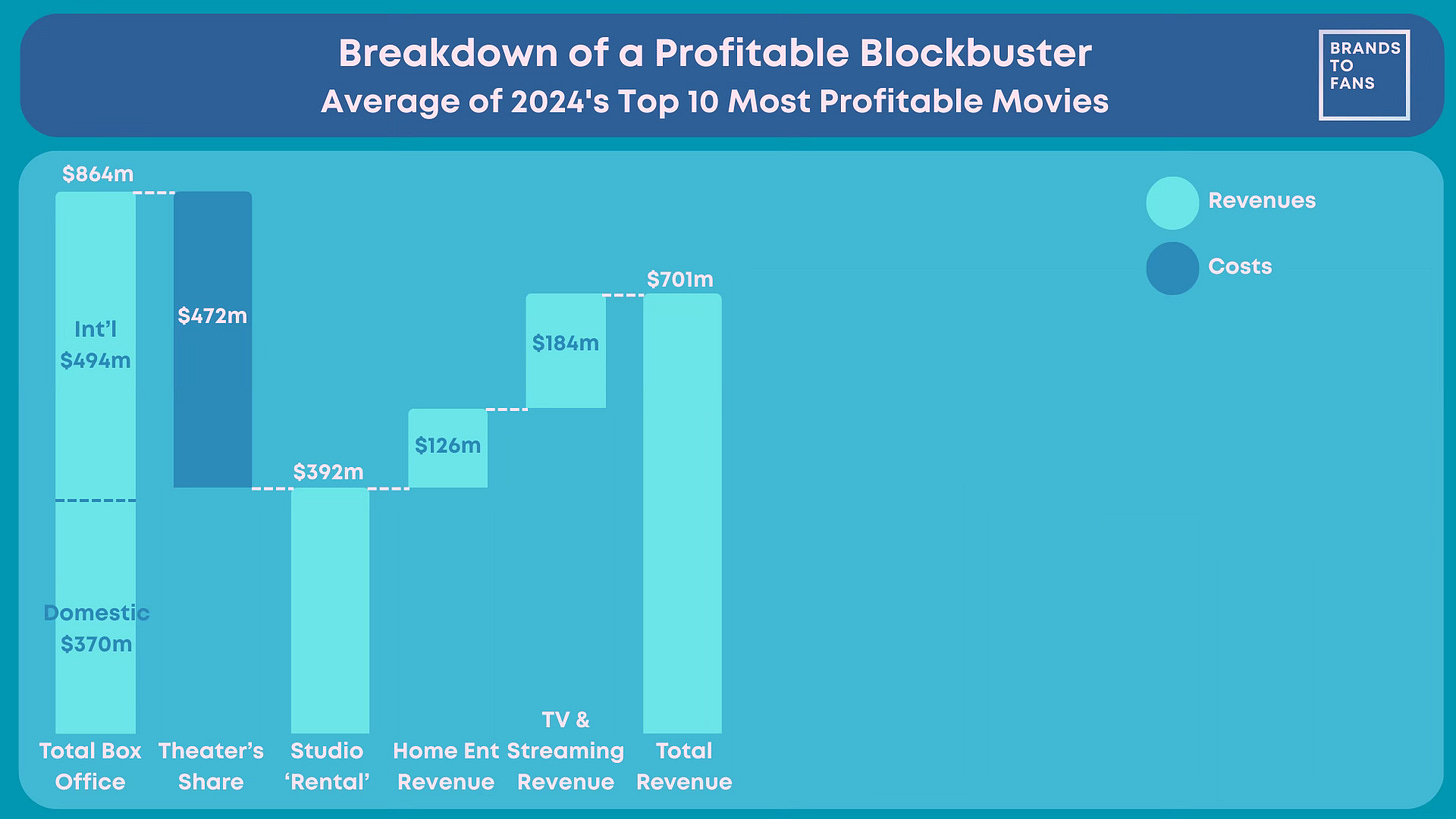

Total revenue

That’s it on the revenue side: Studio Rentals + Home Ent + TV & Streaming = Total Revenue, which for our 2024 Top 10 Most Profitable Movies came to an average of $701 million.

To determine the profitability, let’s start deducting the costs to see what’s left.

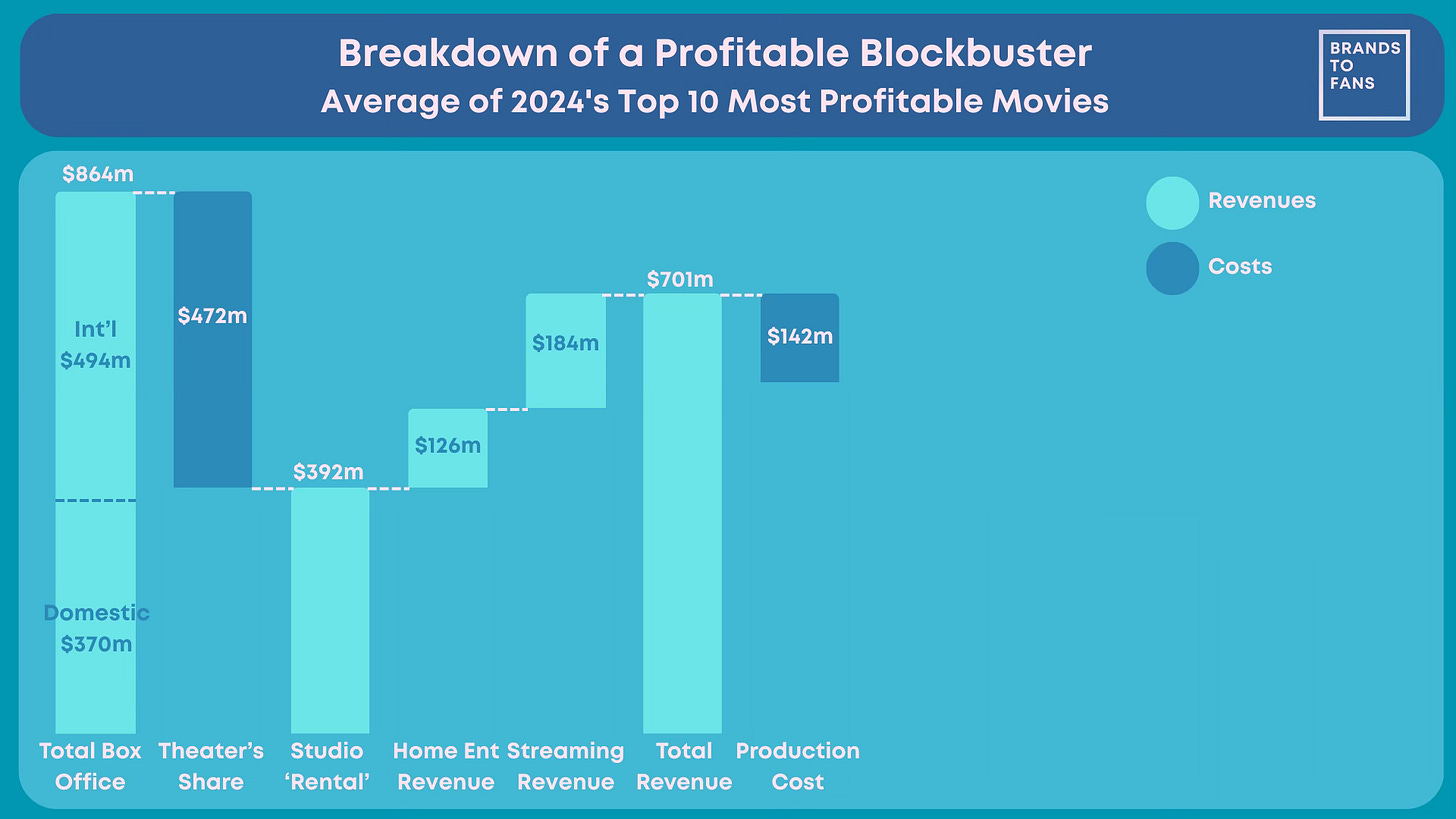

Production budget

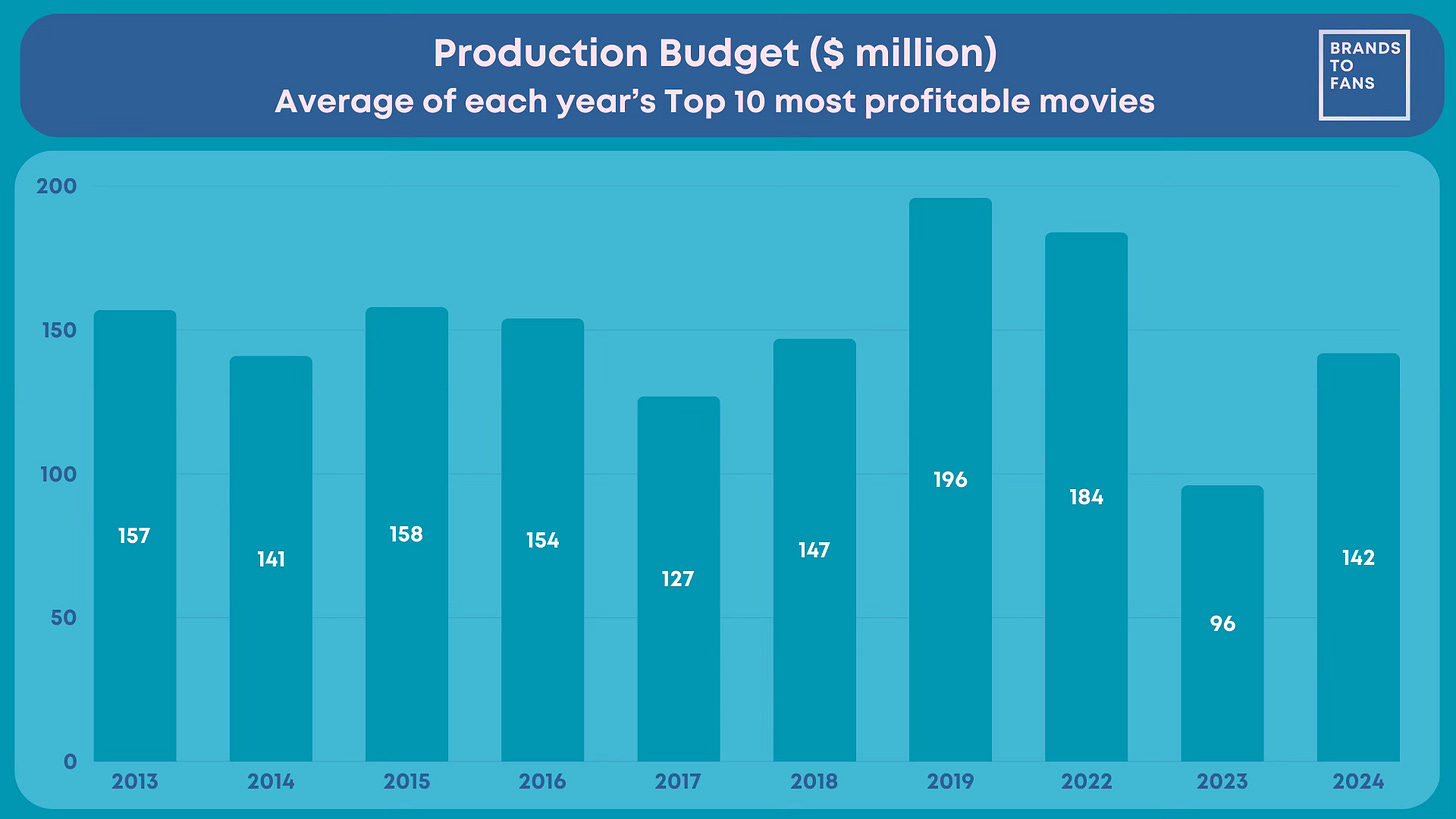

Our 2024 Top 10 Most Profitable Movies had an average production budget of $142 million.

Given budget inflation, I would have expected the 10-year picture to show a clear, continuous escalation in production budgets over time, but it does not:

This shows that within the category of ‘Top 10 Most Profitable Movies’, budgets are fairly consistent. I imagine that those movies with grossly inflated budgets are not as profitable and therefore don’t make it into this data set. If you want to make a profitable movie, don’t let your budget run away from you - who’d have thought?!

The particularly low average budget in 2023 is because that year’s Top 10 Most Profitable Movies included Teenage Mutant Ninja Turtles ($70 million budget) Taylor Swift: The Eras Tour ($15 million); Five Nights at Freddy's ($20 million); and Paw Patrol: The Mighty Movie ($30 million).

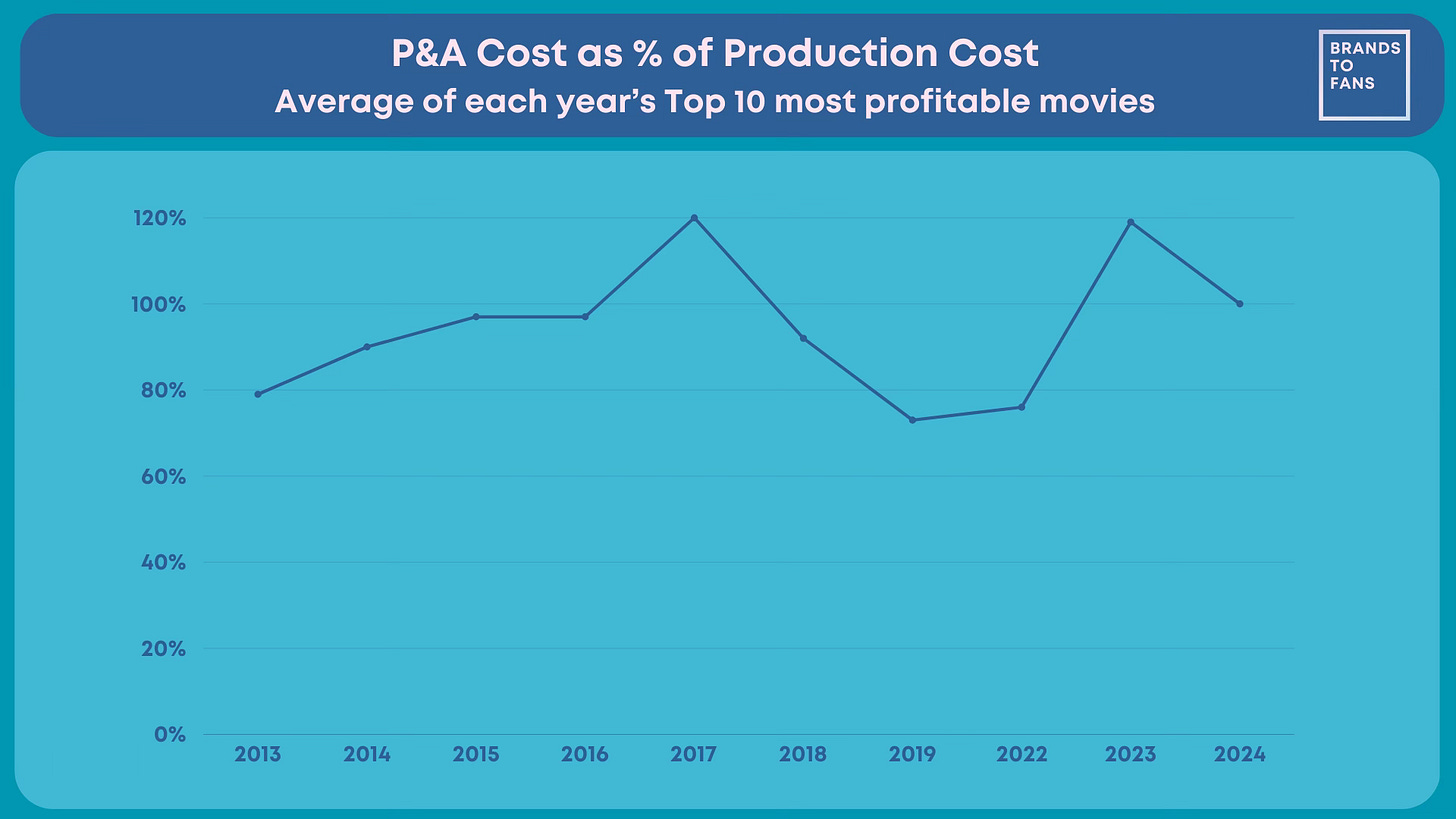

Prints & Advertising

The production Cost is only the beginning. The next major cost is P&A (Prints & Advertising) - i.e. the cost of marketing and distributing the movie. For 2024’s Top 10 Most Profitable Movies, the average P&A cost was the same as the average production cost: $142 million. In other words, for this category of movie it costs as much to release and market it as it does to make it in the first place.

This ratio of P&A cost to the Production Cost has fluctated over time, but a rule of thumb that these two costs are about the same for this category of movie seems reasonable.

Residuals, Interest & Overheads, and Participations

The next three categories of costs are Residuals, Interest & Overheads, and Participations.

Residuals are a form of compensation for those involved in making the movie, for the continued use of their work. These are payments collectively negotiated by the guilds for reuse of a work after its initial release or airing, and are calculated according to formulas established by the guilds and paid by the studio/distributor.

Interest relates to the financing cost of the movie - if you’re spending hundreds of million of dollars up front to make it, there is a cost to cash-flowing that production.

Participations are agreements to share in a movie’s financial success - they are a form of contingent compensation. They can take the form of Gross Participation, paid out of the Box Office revenue (if you’re Tom Cruise), or Net Participation, paid only if the movie is successful and reaches Net Profits.

For 2024’s Top 10 Most Profitable Movies the average costs in these categories were $40 million in Residuals, $28 million in Interest & Overheads and $56 million in Participations.

Studio Net Profits

That gets us to Studio Net Profits, which for our 2024 Top 10 Most Profitable Movies, averaged $294 million.

A general rule of thumb is that for a movie at this budget level to reach net profits, its Total Box Office needs to reach 2.5x its Production Cost.

So, to go back to my example at the top of this article, if you read about a $100 million movie making $100 million at the Box office, that is likely to be an unprofitable movie - it probably needs to make $250 million at the Box Office for the above waterfall to start generating studio net profits for a $100-million-budgeted movie.

Beyond the waterfall

For blockbuster movies at this level, there is additional value beyond the economics outlined above. In success, with the right kind of IP, these movies can drive merchandise sales, theme park tickets, soundtrack albums and so on, as well as setting up and de-risking (in theory, at least) subsequent sequels. That is the real golden upside beyond the waterfall.

News roundup

For this week’s news roundup I am splitting coverage into 2 parts:

‘Follow-up’ news stories that relate to topics covered in previous editions of the Brands To Fans newsletter

General franchise news

Follow-up news

For those who enjoyed Brand Extension Lessons from Monopoly:

The Rich History of Monopoly from Kidscreen Magazine

LeBron James’ Monopoly game is still sold out (and commanding upwards of $5k!), but fans can still buy his limited-edition Nike Monopoly trainers. Read More

For those who enjoyed How the Creator Economy is adapting and supercharging the traditional franchise flywheel:

MrBeast and James Patterson are co-authoring a new thriller novel. And I’m sure they will be writing every word themselves. Read More

Amazon’s head of Prime Video and Amazon MGM Studios, Mike Hopkins, has said the streamer is making more Beast Games - “[we’re] going to do a couple more seasons of that, I think, soon.” Meanwhile, Jimmy Donaldson himself teased that “another 10 seasons could happen.” Read More.

Creators are building their own supersized studio system as Hollywood cuts back. Read More

Peacock is about to launch four new original series that were all developed by social-first video creators. Read More

For those who enjoyed Why all the world's a stage (as long as it's based on a movie):

Nicole Scherzinger gave an interview to the Hollywood Reporter on her Broadway adaptation of Sunset Boulevard. She is ‘manifesting’ a movie adaptation. I live in hope of the unique group of movies-turned-into-stage-musicals-that-are-then-turned-back-into-movies growing in number. Read More

George Clooney’s Good Night, And Good Luck became the first play in Broadway history to gross $4 million in a single week. Read More

A stage musical adaptation of 10 Things I Hate About You is heading to Broadway, with songs by Carly Rae Jepsen and book by Lena Dunham. Read More

Stranger Things: The First Shadow opens on Broadway April 22. Read More

Jennifer Garner is exec-producing a new stage musical adaptation of 13 Going On 30. “Who knew our quirky little movie would have such staying power?” Read More

For those who enjoyed Why live action remakes are not going anywhere:

For those who enjoyed my Liam Neeson/Jason Statham/Gerard Butler smackdown Into The Neeson-verse:

Amazon MGM have secured the Jason Statham sequel The Beekeeper 2 for theatrical release. Production is expected to start this Autumn. Read More

For those who enjoyed Whole Lotta Bluey:

For those who enjoyed How faith-based content is driving innovation in funding, distribution and fan engagement

Dallas Jenkins, the creator of The Chosen, gave an interview to The Wrap about the forthcoming streaming release of Season 5. He says the theatrical releases of this show keep growing season-on-season. “Here in the States, we’re 20-25% over last year already, so we’ll probably end up around 30%. But internationally, we’re up over 100% over last year.” Read More

For those who enjoyed my article on Superfan apps, When Superserving becomes Supersqueezing:

Sesh, a new superfan platform that connects fans with artists via interactive experiences, exclusive content and live events, has raised $7 million, led by Miura Global. Read More

Franchise news

A new Disney theme park has been announced for Abu Dhabi. The park will be owned and operated by Miral under license from The Walt Disney Company, much like Oriental Land Co. owns and operates the Tokyo Disney Resort under license from Disney. Read More

The new Lord of the Rings movie, ‘Lord of the Rings: Hunt for Gollum’, has been dated for December 2027. The team behind the Lord of the Rings movie trilogy (Peter Jackson, Fran Walsh and Philippa Boyens) is reuniting to produce two new films from J.R.R. Tolkien’s Middle-earth. Read More

Disney is deepening its partnership with Epic Games, launching its new Star Wars series within Fortnite. Read More

Netflix will live stream its fan event “Tudum 2025: The Live Event” on the Netflix platform for the first time on May 31. Read More

That’s all for this week - thanks as always for reading!

As someone who is really new to the industry, this was really insightful

Thank you Will, I can see the amount of effort that went into this!

I'm supplementing this post with a couple of comments I have received from email subscribers to the newsletter:

1) The CFO of a major cinema chain writes:

"I really enjoyed reading this as the topic is also one of my pet peeves! However the economics may be even worse if your first chart is GBOR (gross) rather than NBOR (net) to remove VAT and sales taxes. Most third party sources quote GBOR so I thought I’d mention it to you. You may have the same issue with the physical home video sales element. I would expect other revenue and all costs to be net of sales taxes."

It is a great point and the source data from Deadline is not explicit in how is treats VAT and sales taxes. My working assumption was that these figures were Net, but if they are Gross, these taxes will indeed still need to be accounted for.

2) A senior film & TV distributor asks:

"Is the reason you are not seeing much production cost inflation simply a function that you are measuring most profitable movies? If you measured biggest movies or indeed even overall average movies in a year, wouldn’t we see that production cost inflation ? From my perspective I see inflation both in production costs and in growing participations and as such in examining most profitable movies we are by definition not looking at average movie performance, just those with highest revenue and lowest cost - which tend to be the surprise/most difficult to forecast movies?"

He is completely correct - this is a self-selecting data-set of the most profitable movies. The cost inflation that is undoubtedly happening is likely occurring with other movies outside this data-set (and is probably part of the reason they do not reach 'most profitable' status!). I will aim do a separate post on this at some point, looking at all movies rather than most profitable.