A couple of weeks ago, I looked at the economics of the average 10 most-profitable movies for each of the last 10 years.

Within this analysis, I looked at their production budgets and was surprised to find they did not seem to increase over time:

This doesn’t seem to fit with the received wisdom that movie budgets are spiralling ever upwards.

One reader messaged me to ask:

“Is the reason you are not seeing much production cost inflation simply a function that you are measuring [only the] most profitable movies? If you measured biggest movies or indeed even overall average movies in a year, wouldn’t we see that production cost inflation? From my perspective I see inflation both in production costs and in growing participations and as such in examining most profitable movies we are by definition not looking at average movie performance, just those with highest revenue and lowest cost - which tend to be the surprise/most difficult to forecast movies?”

I agreed with this thesis: if our dataset consists only of the most profitable movies, then budget inflation is likely not reflected, because those movies with runaway budgets are less likely to be profitable.

So, I have now analysed a complete set of movies to understand the overall budget inflation level. I expected to see a consistent upwards trend - but this is not what I have found.

A note on methodology:

I looked at wide-release movies ( >1,000 theatres in the US) from 2021-24, to understand the recent, post-covid trend.

A caveat: data sources for budgets can vary in reliability, and in some cases cannot be found at all. The dataset used for this analysis excludes 10% of total titles for which I do not have budget data (these tended to be lower-budget, non-studio movies).

Instead of spiralling inflation, average budget levels across all movies seem to be broadly steady, and even to have fallen in 2024.

And the average ratio of Global Box Office to Budget appears to be trending upward, indicating improving profitability.

Perhaps this dataset was being diluted by an influx of low-budget movies? If more of these were finding distribution, it would keep the average budget level low, even if the bigger-budget studio pictures were indeed becoming more expensive to make.

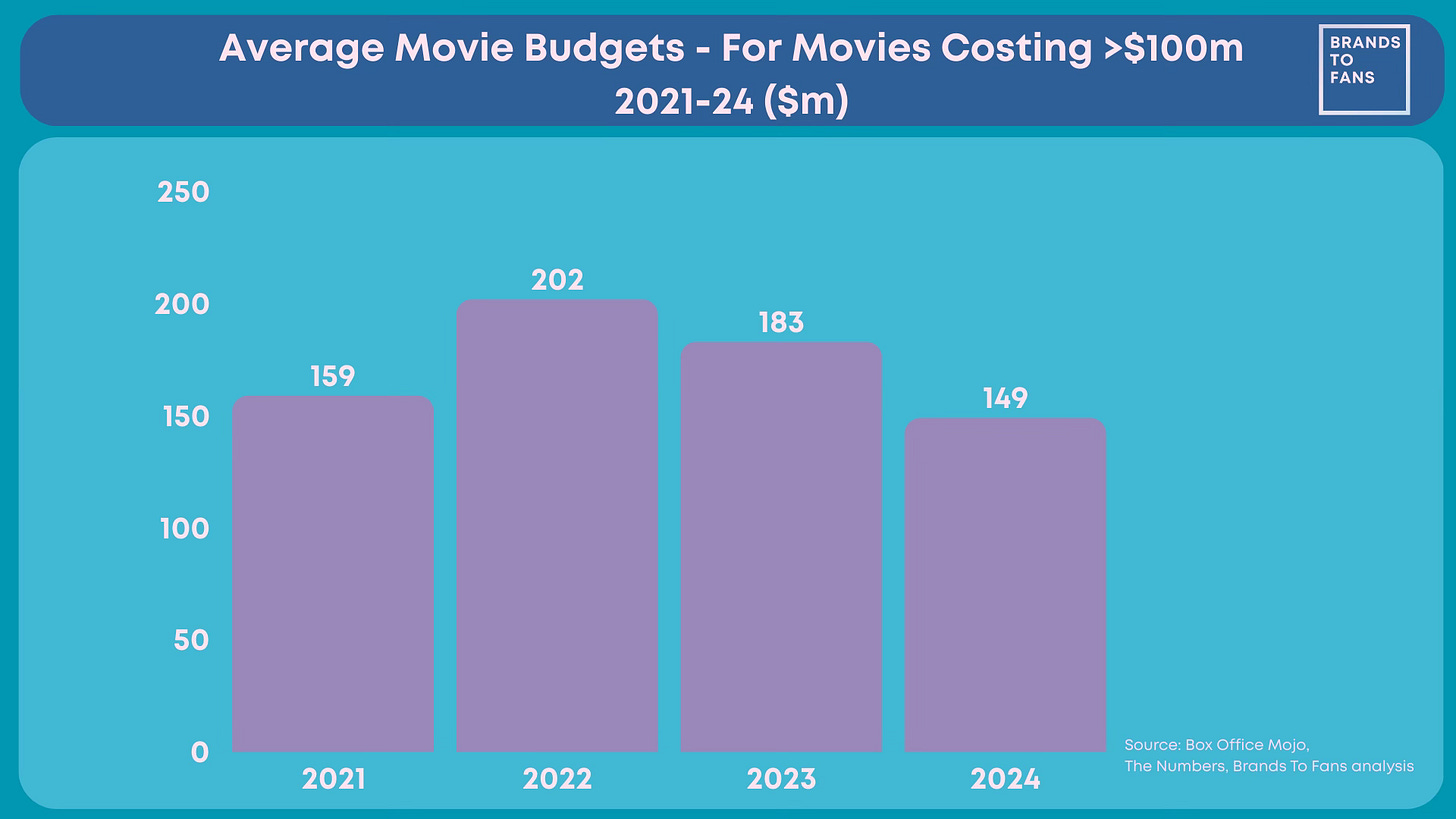

So I re-cut the data, looking only at movies with budgets over $100 million.

It turns out that even within this category of $100 million+ budgeted movies, the average budget has been reducing over time:

And for this category of movies, the profitability indicators have been similarly improving:

I wonder whether our narrative around spiralling budgets is being skewed by a small number of outliers. When you hear that Mission Impossible: The Final Reckoning is costing $400 million, it is easy to think that budgets are out of control. But the overall data across all movies suggests that this is not the case. I’m interested in hearing from readers if you think I’m missing something here, but this is what the data seems to be telling us.

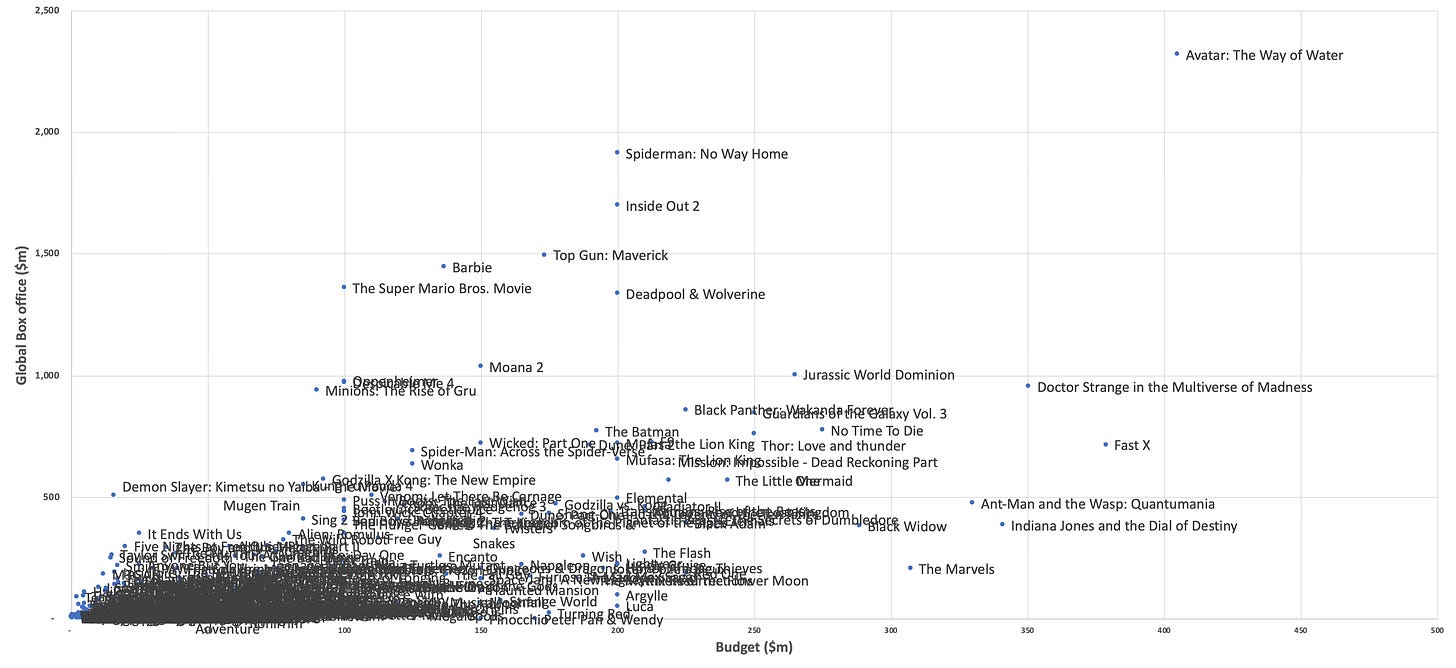

Finally, here is a chart showing Global Box Office vs Budgets for all movies in the last 4 years:

Honestly, that also looks a bit better than I expected. Just eyeballing the chart, there’s a roughly 50/50 split of movies above and below the magic 2.5x multiplier line of Box Office to Budget (which we take as a proxy indicator that a movie is likely to reach profitability).

And for those of you trying to guess the dots, here is an uglier Excel version with labels to squint at:

Franchise news roundup

Action franchises

Anyone who enjoyed my John Wick deep dive might be interested to know that Thunder Road, the production company behind the Wick franchise, has announced a joint venture with billionaire Steve Klinsky’s production company Untravelled Worlds, to finance development for, and also produce, a slate of new films. Read More

Meanwhile, Ballerina (sorry, From the World of John Wick: Ballerina) has hit tracking with a projected $35-$40 three-day debut. Read More

A First Blood prequel, covering John Rambo’s origin story during the Vietnam War, was announced at Cannes. Read More

Stage 🔄 Screen

CNN is going to live-broadcast George Clooney’s Broadway play of ‘Good Night and Good Luck’. Read More

Heathers The Musical is coming to Off Broadway. Read More

TV/Streaming spin-offs

Scrubs is coming back, with Zach Braff. Read More

IT: Welcome to Derry, HBO’s spin-off series from the world of Stephen King’s It, released its first trailer, with Bill Skarsgård returning as Pennywise. I wonder whether this can capture the Stranger Things audience, given that IT inspired that show in the first place. Read More

The recently-cancelled S.W.A.T. is getting a spin-off show, S.W.A.T. Exiles, with Shemar Moore reprising his role as Hono. Read More, with more detail on how the deal came together here.

Tabletop games to screen

Mattel is teaming with TriStar Pictures to develop a live-action/animated film based on its Whac-A-Mole game. Read More

Monopoly Go! has surpassed $5 billion in revenue in two years. Unbelievable. (More on Monopoly in my previous deep dive here.) Read More

The CW has renewed both Scrabble and Trivial Pursuit for a second season. Read More

Faith-based franchises

Mel Gibson’s The Resurrection of The Christ is gathering steam:

Arclight have announced faith-based thriller Syndicate, starring faith-based MVP Jim Caviezel and John Travolta. Read More

Creators

Amazon is licensing YouTube content from indie animator Glitch for its Prime Video service. Shows include sci-fi horror comedy Murder Drones, which has accumulated 270 million views on YouTube. Read More. You can see my analysis of how Creators are segueing into more traditional media here.

Preschool, Kids & Family

Apple TV+ has announced its first Peanuts original musical. Snoopy Presents: A Summer Musical is the first new Peanuts musical special in 35 years. Songs will be provided by Ben Folds, which I think has potential to equal Bret McKenzie and The Muppets for genius musical matchmaking. Read More

BBC Studios continues to expand its Bluey licensing programme.

New deals lean into their “Let’s Play Chef” theme for 2025, including cookbooks, a new digital series, toys from master toy partner Moose Toys, family-friendly cooking supplies from Handstand Kitchen, and small home appliances from Uncanny Brands. I like this themed approach to BBCS’ licensing expansion for this property. Read More

BBCS Digital Brands has also commissioned a new digital-exclusive series called Bluey Dancealongs, turning songs from the series into dance routines for kids to learn and perform. In the absence of new episodes of the main show, they are doing a good job of continuing to produce related content. Read More

BBCS are also taking a leaf from the Bluey playbook for the Hey Duggee brand, launching a digital-first series of celebrity-read-alongs. Read More

Hasbro continue to generate mileage from Peppa Pig’s baby sister, revealed as Evie. New episodes are coming to Netflix in the US, and Netflix is also launching a Peppa Pig mobile game, World of Peppa Pig - a collection of mini-games and videos designed around puzzle-solving, memory, counting, object recognition, and matching patterns. Esra Cafer, SVP Global Brand Strategy at Hasbro, appeared on the Kids Media Club podcast to explain their strategy.

Sesame Street is also moving to Netflix, and there will be an obligatory game as well. Read More

Paramount are making the most of Dora the Explorer’s 25th (!) anniversary with a new live-action movie for Paramount+, Dora And The Search for Sol Dorado, as well as a raft of other Dora content. Read More

Gumball will be returning later this year after a seven year hiatus (providing some cheer for those of us mourning Warner Bros Discovery’s woeful neglect of Cartoon Network and its studios as covered in this Bloomberg article). Read More

Nickelodeon and Spin Master have announced five new hour-long Paw Patrol specials. Read More

Not sure if I missed something, but why specifically look at the pandemic era in this post vs the original which was a decade? It seems a short and abnormal time for movies.

The way I'd heard people talk as the issue was less budgets spiraling out of control, and more about the collapse of the middle, and minimum costs at the bottom becoming untenable due to agent/actors/other above the line costs that made things unprofitable unless you essentially win the lottery.

I'd be interested in the longer term trends in budgets and profitability (as a return on budget multiple, not absolute) of all studio films including p+a from the wide release era (80s) to now (or even all time!) - not just the last few years. I'm not sure where I'd find that info!

I had thought that the fear was that studios find it easier to make fewer bigger bets rather than lots of smaller ones so mid budget films stuff drop out completely (I think you can see this trend with the big publishers in books too).

I'm not sure how true this is based on the actual number of wide release films put out by the studios. I tried to look but it's hard to parse what are acquisitions and what are home grown. Absolute numbers doesn't seem to have changed a lot in the past 15 years, and even before.

For home grown bigger budgets, it would seem to me that a big external driver for this is the busier media environment. I would think it pushes you to make fewer bigger specific bets because in terms of marketing, the branding on a franchise film is done already, and in terms of content spectacle has always been a driver. This is just as the movie star or, before that, the studio itself was the brand. In the late 2000s as movie star influence was fading, studios were effectively putting out a new product line 25 times a year, and now they money is focused on 4 product lines with multiple releases.

Like a lot of these things, I suspect it comes from the discovery problem. How do you get people to notice a film in a competitive landscape? However, all of this logic kills the mid budget and crushes smaller films - unless you can get viral organic growth somehow or do an A24/Tyler Perry.

Availability bias is maybe the problem both in perception of budgets and the attendance of movies!

I think you’d expect costs to fall due to 2022/2023 films fully factoring covid specific upcharges. They’re not completely gone for 2024 films but you’re also not seeing as high cost spirals. That being said I’m not sure they’re even fully factored unto public budgets reported in trades).

Eg eggers’ nosferatu (2024) genuinely cheaper than northman (2022) but the budget gap increased from $10M to $20M due to covid shutdowns