I had the pleasure of speaking at the SEG3 (Sports Entertainment Gaming) Conference in London this week.

For this newsletter, I thought I’d reproduce my talk here. Below is an edited version of my script, together with the slides (and if you want a cooler version of the slides with moving video, you can find that here).

Let’s start at the traditional media end of the spectrum — where IP is no longer just king … it’s cannibal: IP is eating itself.

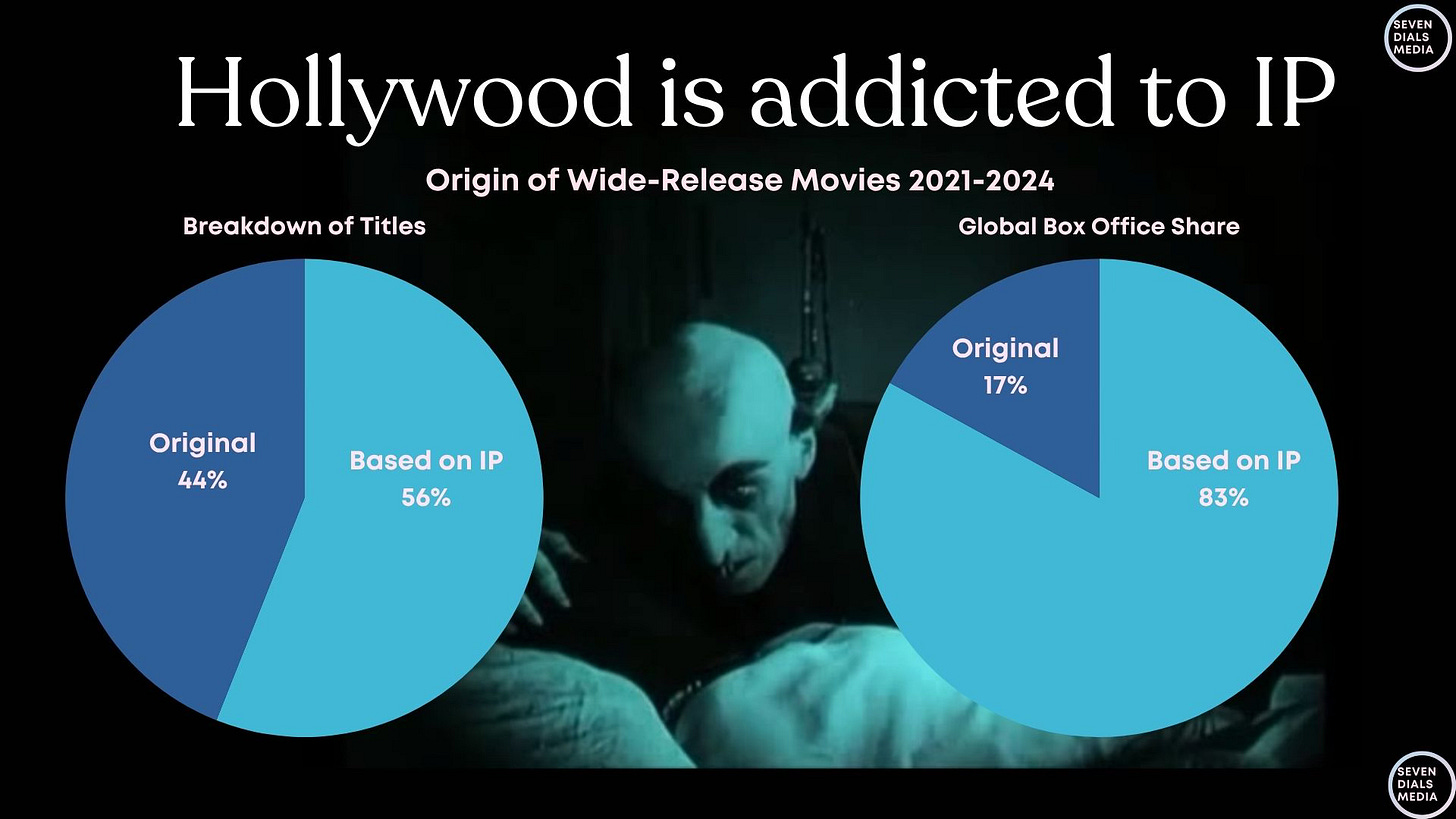

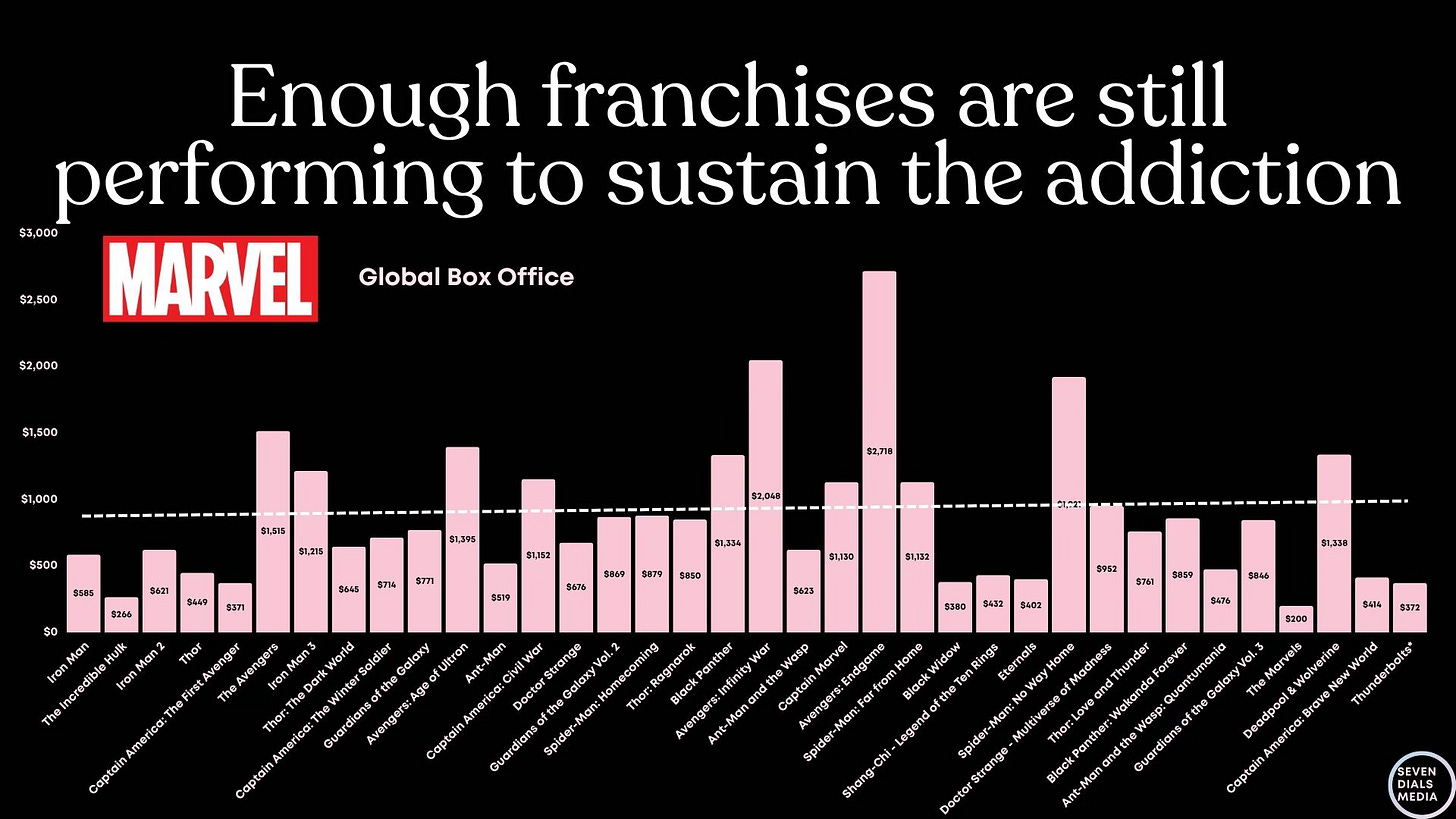

It's no secret Hollywood is addicted to IP. From 2021-24, over half of all movies were based on IP of some kind (whether books, TV shows, previous movies, etc). And those titles generated over 80% of Global Box Office Revenue.

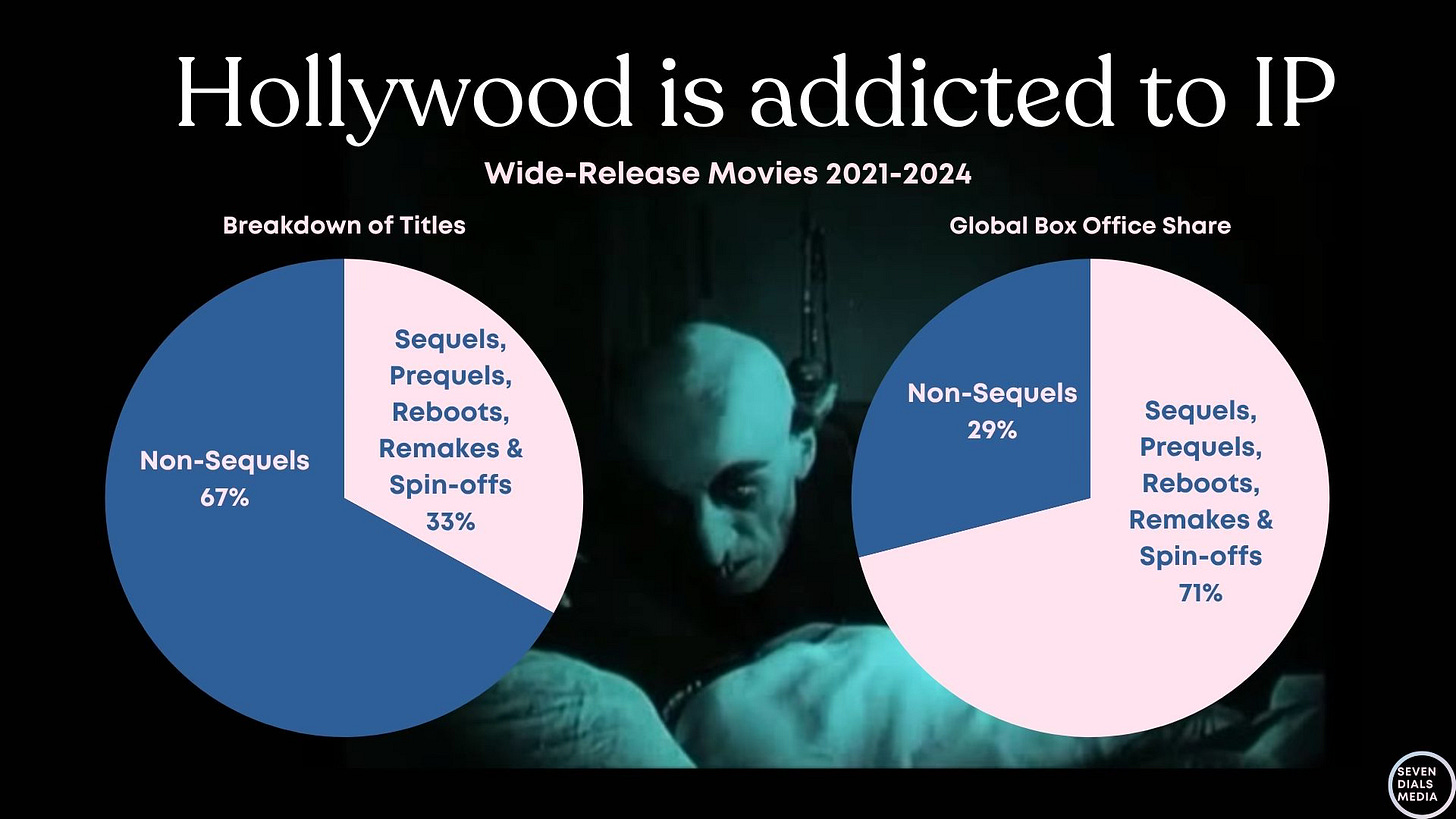

Slicing the data another way shows that sequels, prequels, reboots, remakes and spinoffs accounted for a third of titles released. And over two-thirds of Box Office Revenue.

And that's why Hollywood keeps doing it. They make more money

Franchises are seen as the ultimate risk hedge: repeatable, extendable, and merchandisable.

They promise built-in audiences, multi-channel monetisation … and ideally, a theme park ride.

Enough of these franchises are still performing to sustain that addiction.

Marvel may have overextended and experienced some stumbles lately, but its trendline at the box office remains slightly upward over time. Deadpool & Wolverine made > $1.3 billion at the global box office last year.

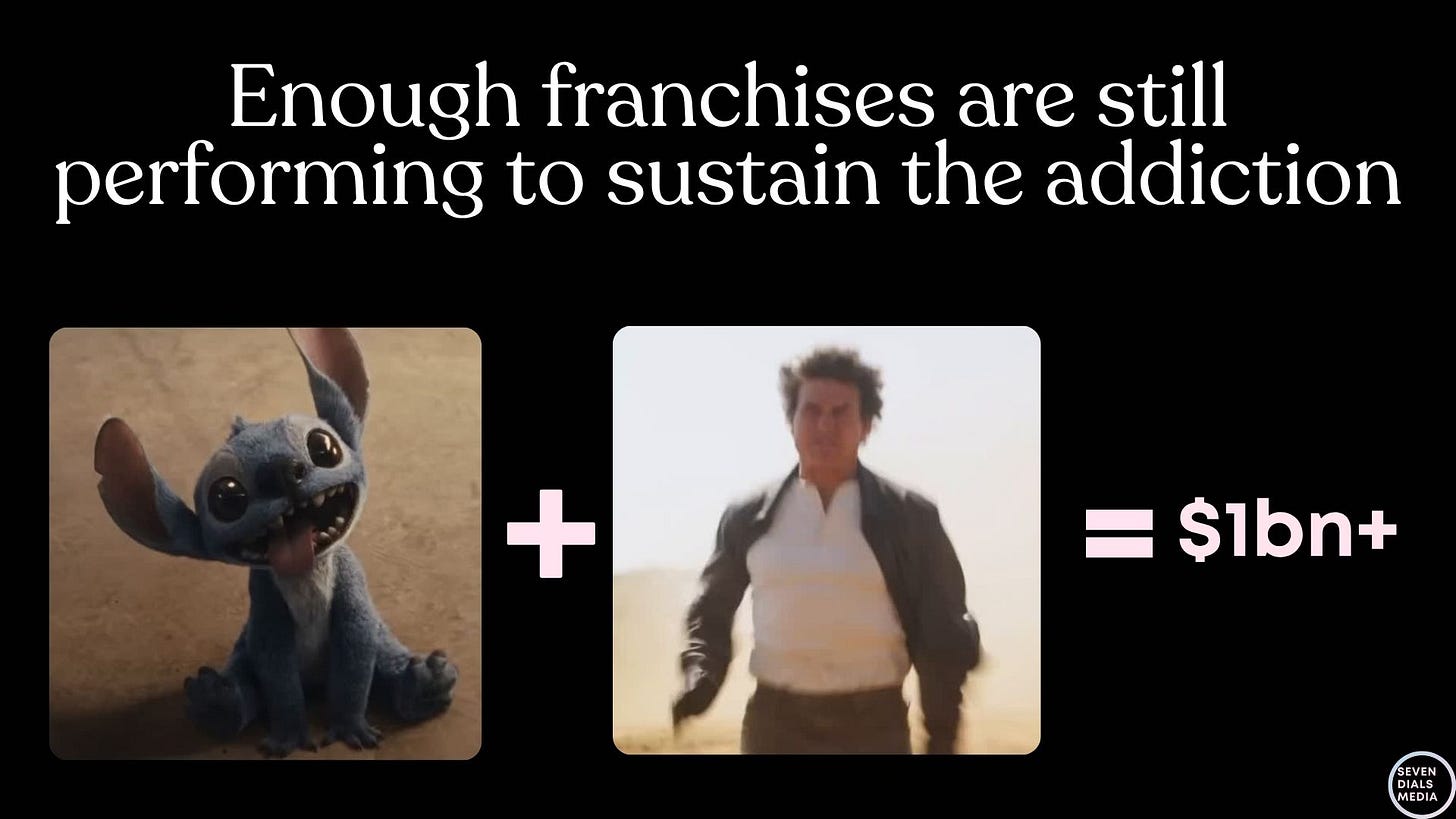

Just last month, these two guys illustrated the point perfectly. A live-action remake, and the 8th in a long-running action series.

Disney’s Lilo & Stitch is now the second-highest-grossing US studio film of 2025 at the worldwide box office (behind A Minecraft Movie) with $770m after three weeks of play.

Meanwhile, Mission: Impossible is at $450m worldwide.

But - the model is fraying. Content is booming. Franchises - not so much

Runtimes and production budgets are out of control.

Mission: Impossible cost $400 million (admittedly partially inflated by Covid costs). So although its box office looks decent, it's not going to make a profit, however hard Tom Cruise runs.

Franchise fatigue is real, and many series feel like they're reaching end-of-life. The 10th Fast & Furious movie, Fast X, was released two years ago, and Fast 11 still hasn't even started filming yet. Vin Diesel has already announced it will be the last in the series.

In 2025, you can spend $300 million and still not create anything worth remembering.

To build a successful franchise, it takes more than a hit.

You need system design, character extensibility, platform-native expansion ... and patience. It takes time.

Too many studios optimise for launch, not longevity.

The rush to meet a release date often trumps a more thoughtful approach.

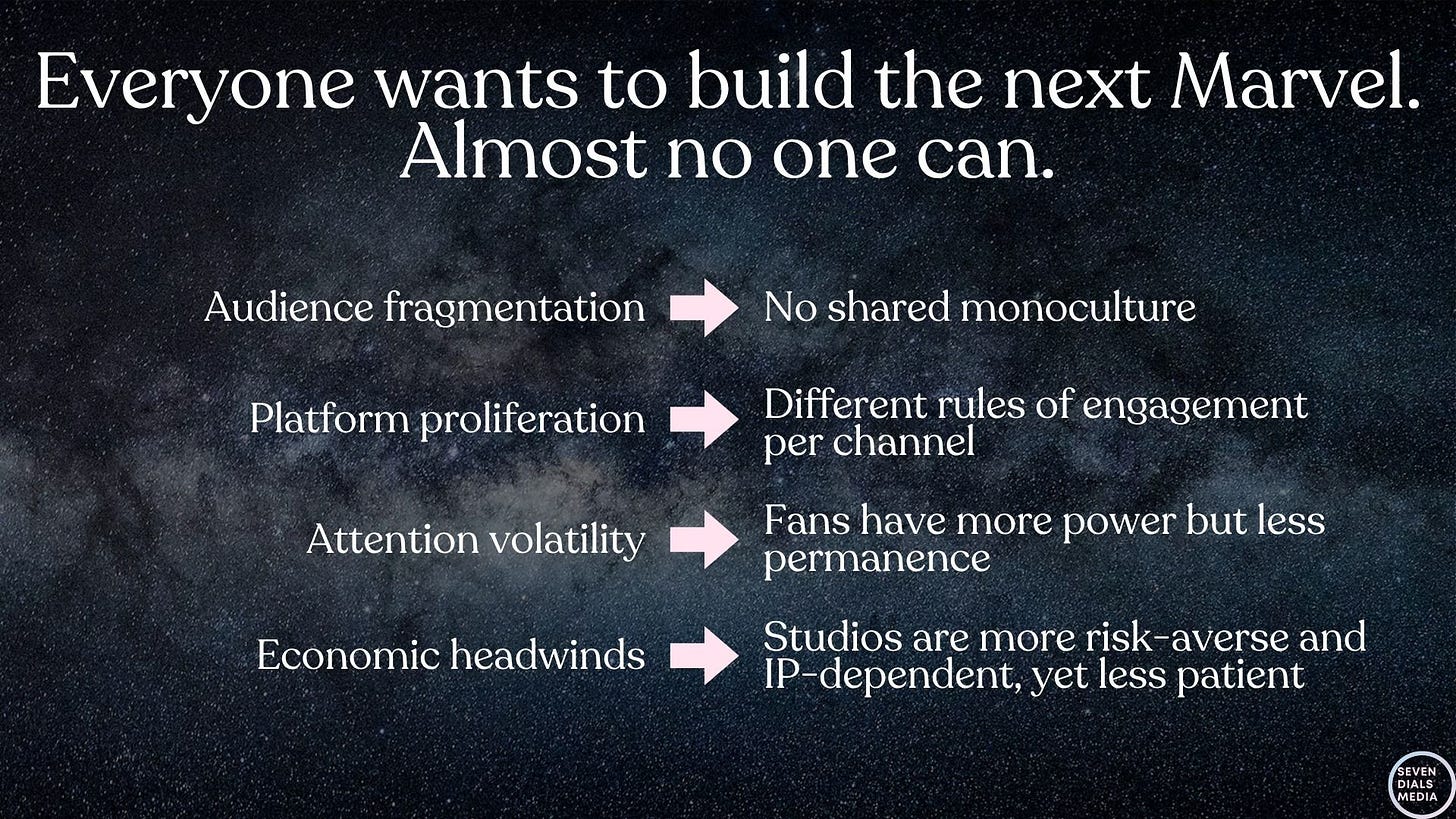

Everyone wants to build the next Marvel. But in today's market, that is hard to do.

The audience is fragmented.

The platforms have proliferated, and each has different rules of engagement.

The fans' attention is more volatile than ever - they have more power, but less permanence; you can lose them pretty quickly.

And Economic headwinds are strong - studios are more risk-averse and IP-dependent. And they are less patient.

Everyone wants multiverse economics. But few can stomach even a one-season flop.

The good news is: new franchises today can come from anywhere. And the rules of engagement are changing.

Studios used to focus on books, TV shows and previous movies for franchise creation.

Now, games have joined the fray in a big way.

Minecraft, Sonic, Mario, Fallout, & The Last of Us have set the template for games-to-screen success.

If you think back to Bob Hoskins in 1993's Super Mario Bros, it's fair to say things have come a long way.

Now, Alex Garland is directing an Elden Ring movie for A24.

And although the games industry has its own challenges, there are a number of indie developers building a pipeline of rich, creative games that are connecting with fans.

Tech developments are lowering barriers to entry.

Unreal Engine 5, plug-and-play assets, mocap-as-a-service, and outsourced pipelines have levelled the playing field — smaller teams can now hit visual and production highs once reserved for the industry’s giants.

Clair Obscur: Expedition 33, which is playing in the background here, is a role-playing game developed by French studio Sandfall Interactive and published by Kepler Interactive. It feels like something that not too long ago would have been made by a team of 500 people, but was in fact made by a team of only 30. It came out 6 weeks ago and has already sold over 3.3 million units.

The number of potential sources for new franchises has now multiplied.

The next big franchise is just as likely to come from a Creator, a Roblox game or a Meme. If it has a fandom, it has franchise potential.

In a world where Skibidi Toilet is now a fast-tracked Michael Bay movie, the IP origin story has been rewritten.

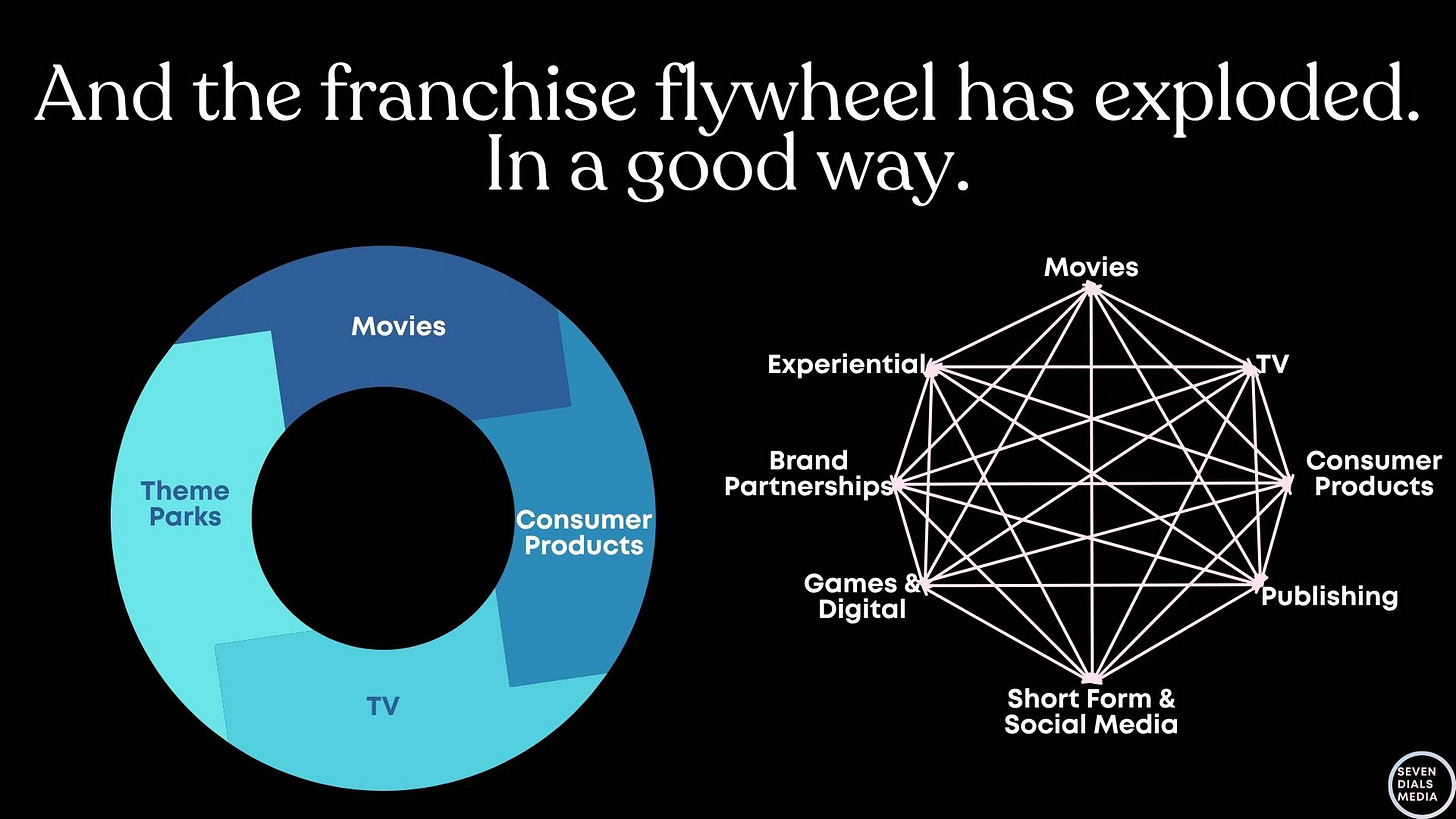

In the old days, building a franchise was comparatively simple - launch a hit movie, sell some toys, hopefully make it to a spin-off TV show, and in great success, slap the brand on a rollercoaster and start working on the sequel.

Now the franchise flywheel has completely exploded. In a good way.

It’s more complex, digitally-driven, and fan-centred. It's more of a franchise matrix.

Each of these touchpoints - Movies, TV, Consumer Products, Publishing, Short Form & Social, Games & Digital, Brand Partnerships, and Experiential in all its forms - can touch and inform one another, from a storytelling point of view and from a commercial and fan experience point of view. And each of them can be the starting point for a franchise.

That is super exciting.

And in the new world order, new playbooks emerge, which I want to touch on now.

The first point I want to make is that Franchises are not built.

We talk a lot about building franchises as though it were an exercise in architecture and construction. But the most successful franchises are grown. Over time.

The process is organic, iterative, and it is rooted in earned, authentic fan connection.

I've pulled together a few examples of brands that I think are doing this well.

Bluey transcends typical preschool content by modelling emotional intelligence, conflict resolution, and imaginative play.

Its nuanced storytelling and humour resonate with both children and adults, fostering family co-viewing experiences.

And it's a case study in organic growth and fan engagement: without aggressive initial marketing, Bluey gained popularity through word of mouth and social media, leading to a dedicated fan base and, now, extensive merchandise lines and a forthcoming movie.

The popularity of Five Nights at Freddy's has grown over the last decade thanks to YouTube Let’s Play videos, fan mods, and lore videos.

The IP isn’t valuable despite the chaos — it’s valuable because of it. Participatory horror is the genre’s new growth engine.

Creator Scott Cawthon embraced fan theories, mods, and content, creating a participatory culture that expanded the franchise's universe.

It has evolved from a game into novels, merchandise, and films, maintaining narrative coherence across platforms.

And feedback from the community has directly influenced subsequent game designs and storylines, demonstrating a flexible and audience-centric approach.

New franchises that resonate are often author-led (in contrast to the top-down, studio-driven model of franchise creation).

Turning to a couple of Amazon Prime Video shows: both Invincible and The Boys benefit from strong authorial voices, ensuring a consistent tone and vision - Robert Kirkman for Invincible, & Eric Kripke adapting Garth Ennis’ graphic novels for The Boys.

They maintain creative control and continuity, and have a clear point of view, often subversive and emotionally grounded.

Fans trust the creator’s intent - especially valuable in a media landscape skeptical of corporate franchise bloat.

And these shows are tailored and paced for streaming platforms. Story arcs are paced and structured for streaming formats, not weekly syndication. They are built with narrative breadcrumbs, long-form character growth, and delayed payoffs.

And they lean into an edgier tone, embracing themes, violence and satire that wouldn't fly in broadcast-safe formats.

Invincible leans into mature animation and long-form continuity. It’s not ‘Saturday morning’ animation.

The Boys exploits its shock factor and dark satire to stand out in a crowded streaming space — while building layered character arcs and spinoffs like Gen V.

The worldbuilding is the connective tissue. Shows like these are designed with an expandable universe in mind, but it’s not about pumping out sequels — it’s about building a rich mythos, lore, institutions, and subcultures.

This encourages fan speculation, theorising, and attachment (which fuels online discussion and retention).

In contrast to the “build a universe backwards from the merchandise” model, this is more: build something compelling enough, and the extensions will be wanted, not forced.

Audiences are tired of franchise-by-committee.

Author-led franchises feel personal and trustworthy.

Turning to sport, Formula 1 as a franchise is now managed, it seems to me, more like a K-Pop property.

Firstly, by humanising the sport through storytelling.

Netflix's Drive to Survive has reshaped F1's image, offering behind-the-scenes access that humanises drivers and team dynamics. By focusing on personal stories, rivalries, and emotional moments, it has attracted a younger, more diverse audience, particularly in the U.S.

F1 and its teams have embraced social media platforms to drive this further, sharing memes and behind-the-scenes content, engaging fans in real-time and growing a sense of community.

Initiatives like ‘Driver of the Day’ voting and race-specific hashtags encourage active fan involvement.

Music events like BLACKPINK's Lisa and Rosé performing at the Miami Grand Prix blended motorsport with pop culture.

On the merchandise front, limited-edition drops and collaborations with brands like Louis Vuitton and Puma have turned F1 into a fashion statement.

And gamified experiences, such as fantasy leagues and apps deepen fan engagement and create personalised experiences.

All of this has had an impact:

Sponsorship revenue has more than doubled since 2019, to $632 million in 2024.

The sport's growing popularity in markets like the U.S. and China shows the success of its new engagement strategies and its potential for further global reach.

F1's embrace of storytelling, digital engagement, and cultural integration signifies a broader shift in how sports franchises can build and maintain global fan bases in the digital age.

In this increasingly complex world, I believe there are some north stars of franchise management that can help you chart a course. These are my Golden Rules.

To begin with, you need to set your IP up for success

The most valuable IP of the next decade won’t be a single character or title — it will be entire worlds. Persistent, explorable environments where fans can live out their own versions of a narrative.

When Hogwarts Legacy was developed at Warner Bros, the ‘unlock’ moment came when we identified from our fan research what every Harry Potter fan’s greatest wish was: to actually go to Hogwarts.

New IP can't and frankly shouldn't go that big at the start. Low-cost experimentation is possible in so many areas now: comics, UGC, fanfiction, and webtoons can all incubate stories that can resonate and grow.

And it's important to remember that Medium Matters: The best transmedia isn’t a copy/paste—it’s about utilising each medium’s unique strengths to reveal new dimensions of the IP.

So treat each medium as a unique touchpoint:

Games are fantasy fulfilment

Toys are identity projection

TikTok is cultural testing

The brand is your guide in all things.

Take the time to:

Identify and understand the brand values deeply.

Articulate them clearly and consistently to all stakeholders and secure buy-in.

Then manage the franchise in a way that is true to that brand and optimises its long-term health.

It follows that your commercial and promotional executions need to be faithful to the brand.

There should be no short-term cash-ins that risk brand damage - a quick buck is the antithesis of managing your brand for the long term.

Segmenting your fanbase enables a more nuanced understanding of their respective needs and preferences, and should be the basis for all your planning.

I don't just mean segmenting demographically and geographically, but attitudinally as well.

Who are the Superfans; who are the Casuals; which fans have Lapsed (and why); where are the Next Generation fans coming from - are you offering entry points for kids to build awareness and engagement?

By using qualitative and quantitative research, you will generate insights and KPIs.

Brand trackers, which measure familiarity, interest, affinity, intent to purchase, and other key metrics, can help you track progress over time. This type of research can provide insights into brand attributes, creative execution preferences, comms strategy, and the most desired products and experiences. Without it, you really are flying blind.

If you do this right and properly understand the nuances of your fanbase, you should be able, when developing new products and experiences, to articulate which of your fan groups you are doing it for, and how it meets their needs.

So these last two slides, the brand and the fans, are the twin lenses through which all decisions are evaluated.

Next, establishing a regular cadence of new and thoughtfully-scheduled content is the backbone of your franchise plan: movies, TV, games, live experiences, short-form and social.

You need a pipeline of content (and associated marketing) to build and sustain awareness, stimulate engagement, and get partners excited and supportive. Licensing & Merchandising can’t grow on its own without a pipeline of content to support it.

When building this pipeline, remember that from a franchise perspective, different content serves different purposes - a movie can provide a burst of mass awareness, while a TV show is constantly accessible and builds regular engagement.

Once your content plan is set, your roadmap should encompass a wide range of consumer products and experiences at varied price points.

Then you need a 365-day engagement plan across platforms and touchpoints to keep fans involved between major content releases.

Optimise your calendar to provide constant news flow, and coordinate franchise announcements to maximise cross-promotion and amplification.

Your brand’s superpower is the range of partnerships you put in place to support it.

So, identify partners who:

Share your understanding of the brand.

Are building for the long term.

Will delight your franchise fanbase.

Can amplify your brand value.

It is important that your partners meet a defined quality and materiality threshold. Partnerships are time-consuming to execute and manage, so select wisely and don’t waste time with short-term, low-value partnerships

And, selecting partners is only half of it: once they’re onboard, the real value is generated by how you manage them. It’s important to practice deep partner engagement/account management.

Bring your partners inside the tent - include them in your franchise briefings and make them feel part of it

Get the deal right.

The best creative in the world won’t build a lasting franchise if the necessary commercial structures and rights aren’t in place.

Finally, set yourself up for success by organising your team structures and processes to support franchise management.

Maintain a franchise-wide P&L so you can see the whole picture. I've worked with businesses where the economics of the IP sit within different verticals within the business. You need to pull them out, allocate appropriate costs and establish a true P&L.

Only by doing this and establishing KPIs can you understand and quantify the 'size of the prize' - the uplift that a successful franchise management approach can bring – which in turn provides the context for investment decisions.

Next, have a Chief Creative Officer to act as brand guardian and ensure consistency and quality control when it comes to the brand.

And thirdly, invest in central Franchise, Research, and Social Media functions. Your Franchise team should be a single source of truth for franchise datapoints, performance KPIs, research, assets, sales materials and so on. Information should be centralised - and then disseminated widely and frequently.

So, to get back to the exam question. If you do all that right - Can you build a forever franchise?

Well, I'm sad to say, no franchise lasts forever. Everything has a life-cycle.

All things must pass. Even Tom Cruise must retire at some point.

As Rutger Hauer says in Blade Runner:

“All those moments will be lost in time, like tears in rain"

And actually, that’s fine! The torch passes, and new generation franchises emerge.

But! As everyone in this room knows: All good stories come with a twist.

And in fact, IP never truly dies.

They killed off John Wick at the end of Chapter 4 (spoiler alert!), and they're still bringing him back for Chapter 5.

So when you reach the end of the road, the thing to say is:

“This franchise isn’t dead, it is merely resting”

In fact, resting a brand is a strategy.

As last month's release of Final Destination: Bloodlines showed, absence (combined with an actual good movie) can make the heart grow fonder.

This sixth film in the franchise, released after a gap of 14 years, has already become the highest-grossing of the series, at over $260m Box Office (on a $50m budget).

So, take heart, and remember...

... as Chuck Palahniuk said:

The goal isn't to live forever.

The goal is to create something that will.

Franchise news roundup

Each week, we round up franchise management news, focusing on items that relate to previous newsletter topics.

Theme Parks & Immersive

(Read my theme park deep dive here and Immersive deep dive here).

A Stranger Things immersive experience, called Stranger Things: Catalyst, will launch at Sandbox VR locations in late 2025. This is Sandbox’s third collaboration with Netflix, following Squid Game Virtuals and Rebel Moon: The Descent. Read More

A new report shows that Disney’s US theme parks contribute $67 billion to the US economy annually. Read More

Preschool, Kids & Family

(Read my post Whole Lotta Bluey here.)

Coolabi have appointed Neil Court as chairman as the business enters a new stage of growth. Through their book packaging business, Working Partners, they have a slate of wholly owned IP, which they are now building into franchises. Their biggest hit, Warrior Cats, has sold 77m+ books and is a huge success on Roblox (600m+ plays) and social media (1.9b+ TikTok views). Read More

Bluey is taking over Fruit Ninja Classic+ on Apple Arcade. Read More

Action franchises

(Read my action smackdown post Into The Neesonverse here and my John Wick deep dive here.)

If you’ve seen Ballerina at the cinema, I highly recommend the latest episode of the Going Rogue podcast, which goes deep on the gestation, production history, and reshoots of this John Wick spinoff. It is expertly researched. Listen Here

Ballerina currently stands at $52 million globally after 1.5 weeks, which is not great for a movie with a reported budget of $90 millon. Read more

Faith-based franchises

(Read my post How faith-based content is driving innovation in funding, distribution and fan engagement here.)

The Hollywood Reporter ran an excellent profile of Angel Studios, which is going global with a network of international output deals. Read More

Stage 🔄 Screen

(Read my post Why all the world's a stage (as long as it's based on a movie) here.)

CNN’s airing of the George Clooney play Good Night, and Good Luck secured 7.34 million viewers globally - the first time a live play has been broadcast and televised around the world. Read More

Live-action remakes

(Read my post Why live-action remakes are not going anywhere here.)

How To Train Your Dragon releases this week and is tracking for a huge $175M-$185M opening at the global Box Office. Read More

Meanwhile, Lilo & Stitch secured its third week at No. 1. Read More