How to get a sequel greenlit

What's a movie gotta do to get a sequel around here?

The new Conjuring movie, The Conjuring: Last Rites, purports to be the final instalment in the saga. But it just achieved an opening weekend of $187 million worldwide (the second biggest global opening ever for a horror movie). And one thing we know about Hollywood: numbers like that positively demand a sequel.

Hollywood’s sequel machine is relentless. But behind every greenlit Part 2 lies a calculation: did the first outing make enough money to justify another spin of the wheel?

To answer that, I ran the numbers on 100 titles that went on to spawn sequels. The results give us an empirical picture of what ‘enough’ really means.

Methodology

First, some explanation and caveats about the methodology used:

My starting point was to focus on movies released in the last 5 years (partly because I wanted recency, but also because that is the scope of my core database).

Identifying sequels released in the last 5 years, I then went back to their predecessor movies to analyse the performance level that had led them to spawn a sequel.

I also included movies released in the last 5 years that have themselves spawned sequels (even if those sequels have only been announced, rather than released, such as The Garfield Movie. I appreciate that not every announced sequel makes it to production, but I think that those included here will).

Exclusions:

The analysis excludes ‘legacy sequels’, which are a unique category with their own greenlight rationale and are probably deserving of their own deep dive newsletter. By definition, their previous instalments took place a long time ago, so analysing their predecessors’ Box Office performance and profitability doesn’t reflect how a movie has to perform today to get a sequel (which is really the focus of this piece).

This means that the following movies, all of which generated sequels in the last 5 years, are not included: The Exorcist, Top Gun, Beetlejuice, Ghostbusters II, Space Jam, Gladiator, The Matrix Revolutions, 28 Weeks Later, Clerks II, Indiana Jones and the Kingdom of the Crystal Skull, and The Karate Kid (2010).

I also excluded sequel-generating titles that were released straight-to-streaming due to the pandemic (e.g. Trolls World Tour).

And I excluded Mission Impossible: Dead Reckoning Part I, as its sequel, The Final Reckoning, was greenlit, and largely shot, at the same time, and so was not dependent on Part I’s performance for a greenlight.

A caveat: I have used the ratio of Box-Office-to-Budget as a proxy for a film’s profitability. We saw in a previous post that a Box-Office-to-Budget ratio of 2.5x is a fair benchmark for profitability for blockbuster movies. However, as

points out, budget data for movies is notoriously unreliable, often originating from a studio’s PR department rather than validated, cross-checked sources. A pinch of salt is therefore required when examining these numbers, but I still think the analysis is worthwhile as a broad-brush indicator.

Let’s tuck in.

The films

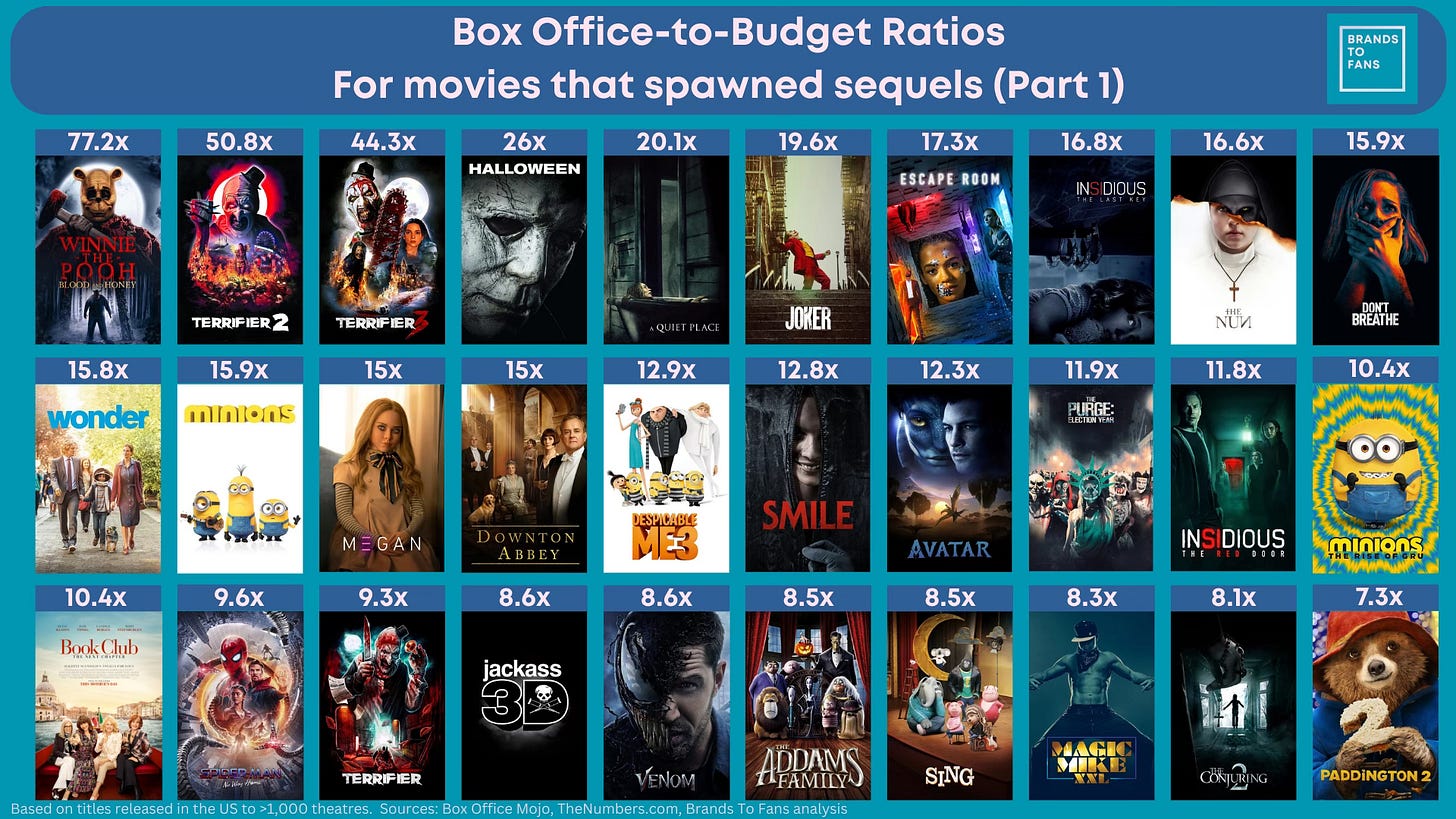

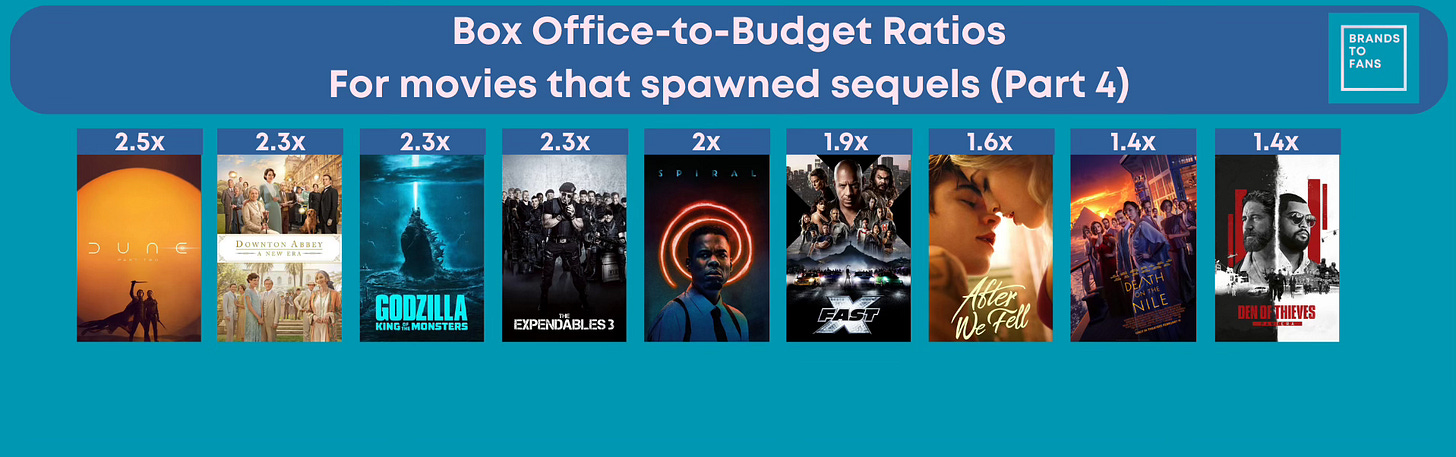

Before I have you squinting at scatter-charts, here are the movies analysed, ranked by their Box-Office-to-Budget ratio:

Unsurprisingly, the outliers at the top end of the profitability scale are micro-budget horror movies.

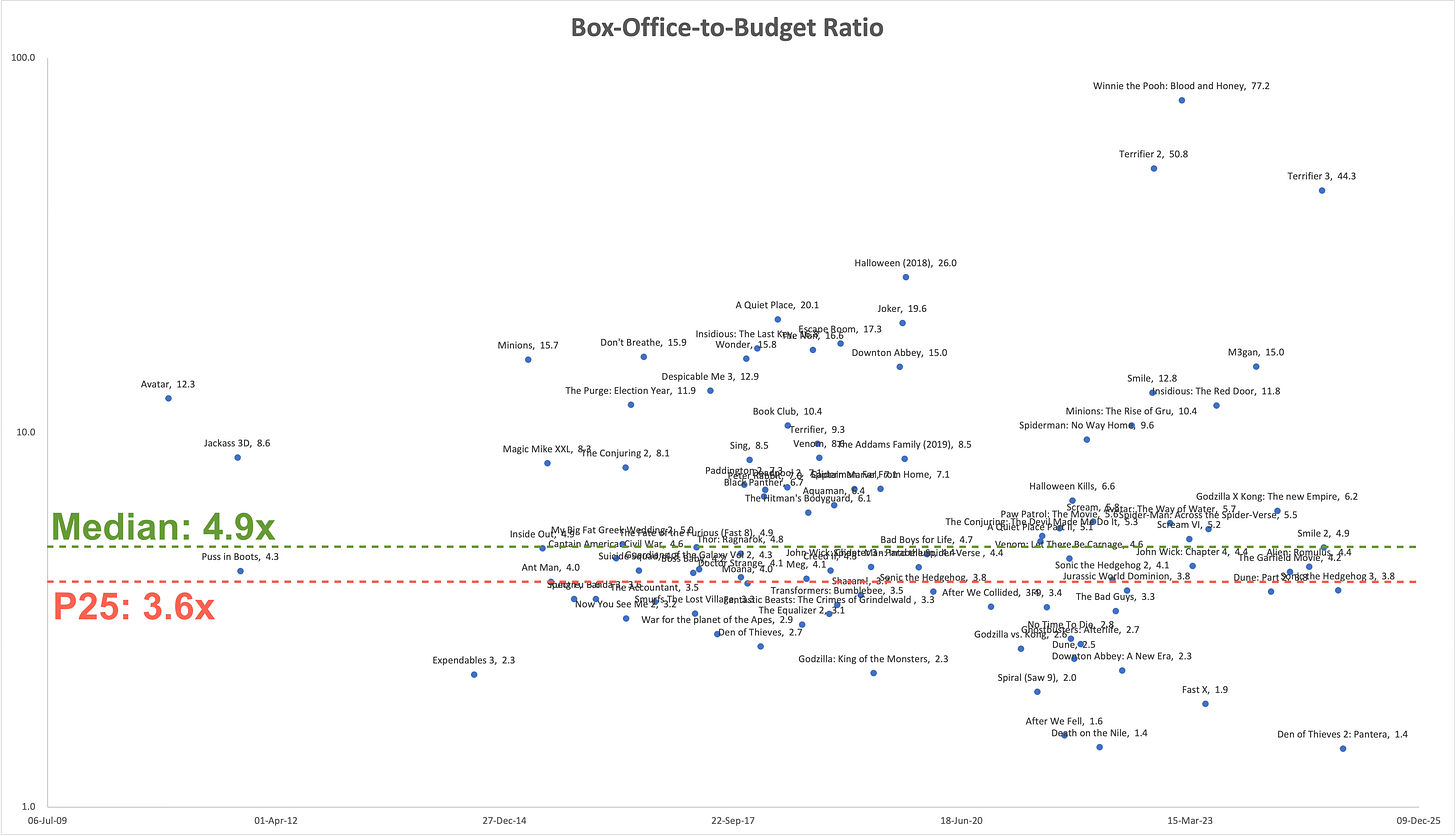

Laying the datapoints out over time, most are clustered below the 10x mark, making it hard to see the detail.

Laying the same data out with a logarithmic scale, the spread becomes more visible.

The sequel-generating floor: ~3.6× Box-Office-to-Budget

The dataset shows the following pattern:

Median ratio: 4.9× (i.e. a sequel-generating film typically grossed nearly five times its budget).

Lower quartile: 3.6×. I’m taking P25 (the 25th percentile) as the empirical threshold: 3.6x. Three-quarters of sequel-generating films cleared this line.

Outliers: Some dipped well below 2× and still got follow-ups (Fast X, Death on the Nile). To earn a sequel at this level, other factors are probably at play (see below).

Why the maths isn’t the whole story

Not every high-performing movie is suitable for a sequel, so there will be films released in this period which were highly profitable but won’t get a follow-up (I doubt we’ll be seeing Oppenheimer 2, for example…).

And studios don’t greenlight sequels on spreadsheets alone. Here are my Top 12 drivers for a sequel greenlight:

Reduced perceived risk: Sequels are inherently seen as less risky by studios. Audiences already have awareness and a relationship with the original film's characters and world, increasing marketing efficiency and making it a safer bet for attracting viewers, compared to an unknown original story.

Growing the flywheel: Diversifying revenue streams across merchandise, theme parks, TV shows, streaming deals, and licensing can make a sequel part of a broader ecosystem rather than a standalone cash cow. Flywheels require fresh content to drive engagement and excite partners, so a sequel can help keep this wheel spinning even if its standalone economics are not the most compelling.

Brand maintenance: Keeping an IP alive in public consciousness (Saw, Transformers). This is the ‘maintenance dose’ theory - not every sequel is meant to grow; some exist to stabilise. They keep the brand’s pipes unclogged - merch renewals, licensee confidence, etc - even if the film’s theatrical ROI barely clears. These ‘maintenance wins’ can be measured by catalogue uplift and cross-window value, not opening weekend.

Boosting the back catalogue: a fresh instalment of a film series can trigger new TV, streaming, and home entertainment releases of the story so far.

Narrative Closure: A sequel to complete a story arc (Dune: Part Two).

Star/Talent Leverage: Retaining a bankable cast or director who wants another outing.

Chasing an earlier profitability ‘high’: Kenneth Branagh’s Death on the Nile grossed $137 million on a budget of approx $95 million, a ratio of only 1.4x, which is far below our threshold. Why then did it generate a sequel? The answer probably lies in the previous instalment, Murder on the Orient Express, which achieved a Box-Office-to-Budget ratio of 6.4x ($353 million Box Office on a budget of $55 million). Death on the Nile may have dipped significantly and was probably loss-making, but the sequel greenlight decision that led to A Haunting in Venice would have been made in the hope of a return to the previous glory of Orient Express.

Streaming Value: Sequels can boost subscriber acquisition and retention on platforms, making them strategically valuable for studios with their own streaming service (i.e. everyone apart from Sony, who instead get to enjoy rich licence fees).

Foreign Market Appetite: International returns can outweigh domestic weakness (Bond, Fast & Furious). And sometimes films are de-risked through international pre-sales, which changes the risk profile for the greenlight decision and can lower the producers’ performance threshold for profitability.

Genre Economics: Horror franchises in particular can print money at a low cost (Terrifier, Insidious). A low-budget sequel is a much easier greenlight decision to make.

Corporate strategy and slate demands: Sequels as filler to plug content pipelines during mergers, strikes, or delays. With the intense demand for content, especially for streaming services, sequels can help fill out production schedules.

Momentum and a shot at building a franchise: although a sequel may itself not be hugely profitable, if it is well received and generates momentum, it could be a step on the path towards the sunlit uplands of true franchise-dom, the lure of which can justify taking another step on the journey

For example, Den of Thieves 2: Pantera has the lowest ratio in this dataset, with a BO-to-Budget ratio of 1.4x, but it is exhibiting momentum that should see it through to a 3rd instalment in the hope of taking it to the next level.

It was a No. 1 movie at the US Box Office with an opening weekend of $15 million (beating $11-$13 million expectations) and debuted at the top of Netflix’s film charts on its streaming release.

In addition, several international territories were pre-sold, changing the risk profile (see point 9).

Den of Thieves 3 has not been formally greenlit yet, but it is in active development, and I expect it to happen (also, one of its producers reads this newsletter, so we’ll see whether this flushes out a comment!).

If you’re an exec considering a potential sequel, you can start with the Box-Office-to-Budget ratio - aiming for north of 3.6x. But the real decision hinges on a wider portfolio logic: brand equity, cross-platform value, and long-term audience management.

Sequels, in other words, are less about arithmetic and more about insurance. They’re bets not just on profit margins, but on keeping the IP flywheel spinning.

What do you think I’m missing from the sequel calculus? Let me know in the comments!

Latest news in franchise management and commercialising IP

Franchise Management

(Read my presentation “Building a Forever Franchise” here.)

Amazon Prime Video’s Tomb Raider live-action series is finally going into production. Phoebe Waller-Bridge is the creator, writer, and executive producer, and Sophie Turner will play Lara Croft. Read More

Paramount has struck a deal with Activision to adapt the video game Call of Duty. Paramount will develop, produce, and distribute a live-action feature film based on the game franchise, which has been the top-selling series in the US for 16 consecutive years, selling more than 500m units worldwide. Read More

The Bar for Superhero Films Has Been Raised, Sony Pictures CEO Says: ‘You Can’t Make a Bad Movie’. Speaking at a recent Bank of America conference, Ravi Ahuja said, “I think [the bar] for superhero movies was relatively low. In the mid-2010s pretty much all of them would do incredible business, but now even superhero movies have to have a degree of originality. They have to add something different. They have to have emotional connection. They have to be cultural events that can be marketed that way.” Read More

wrote a great piece, “What If All Media is Marketing”, explaining why content is increasingly a loss leader or top-of-funnel for something else. As AI drives down content-creation costs (and margins), content ends up as a loss leader for building awareness and engagement, with monetisation happening elsewhere in the franchise flywheel. So, now more than ever, IP owners need to develop and monetise their franchise flywheel. Read More

Animated extensions

(Read my post “Getting Animated - how to extend live-action franchises into animation” here.)

Animated series Tomb Raider: The Legend of Lara Croft has been cancelled by Netflix. While the new live-action adaptation gets a greenlight at Amazon, Season 2 of Netflix’s animated Tomb Raider show, which releases in December, will be its last. Read More

Amazon Prime Video has handed a series order to an animated kids spin-off from The Chosen. The Chosen Adventures, an animated adventure comedy series about Jesus of Nazareth, will be produced by Amazon MGM Studios and Dallas Jenkins’ 5&2 Studios banner. The series will consist of 14 x 11-minute episodes. Read More (See also my post “How faith-based content is driving innovation in funding, distribution and fan engagement” here.)

Kids & Family

(Read my post “Whole Lotta Bluey” here.)

The feature-length Bluey movie will be released in cinemas on August 6, 2027. BBC Studios is financing and licensing the picture with theatrical distribution through Walt Disney Studios. Read More

A new Bluey motion-controlled video game is launching. BBC Studios has teamed up with Nex to develop an interactive motion-powered Bluey game for the Nex Playground. The game will launch in October and features several mini-games inspired by fan-favourite episodes, encouraging players to activate dance mode, play Keepy Uppy, and have fun with the magic asparagus. Read More

Hundreds of classic Sesame Street episodes will launch on YouTube. Sesame Workshop has struck a deal with YouTube, making the platform home to the largest digital library of Sesame Street content available, in addition to new made-for-YouTube content. Meanwhile, Sesame Street will also debut new episodes on Netflix and PBS in November. Overall, a great combination of reach-building and monetisation. Read More

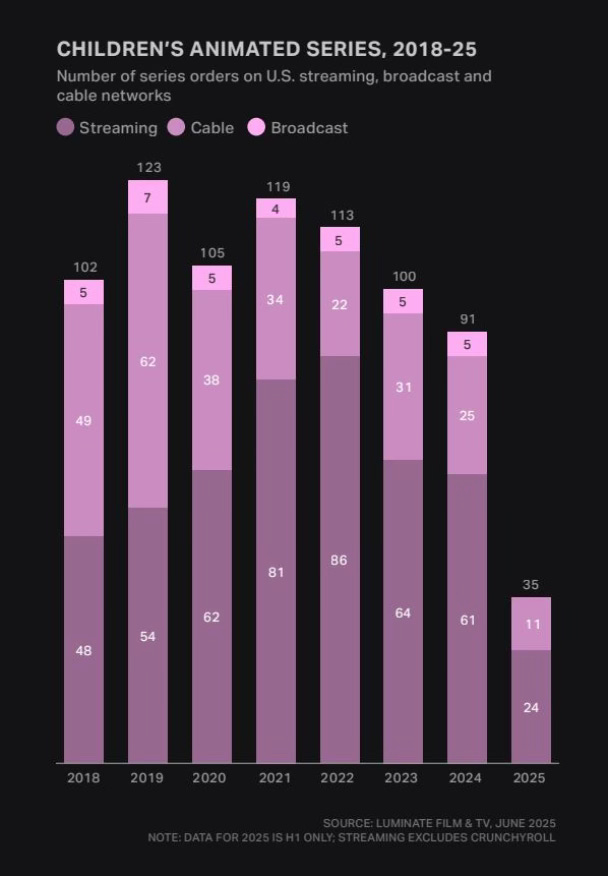

Luminate released data highlighting the decline in children’s animated series commissions. The chart below shows the number of series orders on children’s animated series by US streaming, broadcast and cable networks from 2018 to H1 2025 (remember the 2025 column on the right is only for the first half of the year - but still: ugh). Read More

Corus halts Nelvana’s production operations. In light of the news item immediately above, it might be less surprising to learn that Canadian animation giant Nelvana ceased production work as of last week, as owner Corus Entertainment continues to grapple with broader business challenges. Read More

Theme Parks & Immersive

(Read my “Theme park deep dive” here and “Immersive deep dive” here.)

South Korea’s Everland theme park is bringing KPop Demon Hunters to life with a new, immersive themed zone, launching September 26. The zone will feature storylines and characters from the film, including Huntrix and Saja Boys, as well as K-food ‘to invite visitors into the movie’s universe’. This is the third time the theme park has collaborated with Netflix, following last year’s zones based on All of Us Are Dead and Stranger Things. Read More

Creators

(Read my post “How the Creator Economy is adapting and supercharging the traditional franchise flywheel” here.)

The Sidemen are expanding the programming on their Side+ streaming service to include shows from other creators. “It can hopefully become a place where any UK creator can come and potentially realise a video idea they had for a long time but didn’t have the chance to make,” says Sidemen Entertainment MD Victor Bengtsson. Read More

Live-action remakes

(Read my post “Why live-action remakes are not going anywhere” here.)

Questlove’s live-action adaptation of Disney’s the Aristocats has been scrapped: “Just Wasn’t Meant To Happen”. Read More

Stage 🔄 Screen

(Read my post “Why all the world's a stage (as long as it's based on a movie)” here.)

The theatrically-released recorded performance of Hamilton was the #2 movie at the US Box Office this weekend, taking $10 million. It’s the same recording that has been available on Disney+, accompanied by a reunion Q&A with cast members. Read More

Podcast franchises

(Read my post “Podcasting enters its franchise era” here.)

Disney Entertainment Television is launching a series of video podcasts on Disney+ and Hulu to boost fan engagement. The first to launch will focus on Only Murders in the Building, and feature conversations with cast members and creatives. Episodes will be available in the U.S. on Disney+, Hulu and Hulu on Disney+, and will also be distributed on YouTube and the usual audio channels. Read More

Desktop games

See my Post “9 brand-extension lessons from Monopoly” here

Mattel teams up with Billie Eilish for new Uno edition. The Uno Canvas Billie Eilish Deck blends Billie’s signature streetwear style, the Blohsh logo and a bold green palette with the timeless Uno design. Read More

This is an impressive amount of work and thought!